In April, the hog price rebound quickly yielded results according to the listed pig enterprises’ sales briefing. The companies – Muyuan, Wen’s, Aonong Bio and Zhenghong – showed an increase in pig sales and enterprise income. The hog price of Muyuan increased MOM for the first time in nearly five months.

The increase in sales revenue of the listed pig enterprises is mainly due to hog prices. There are five reasons:

1. Reproduction

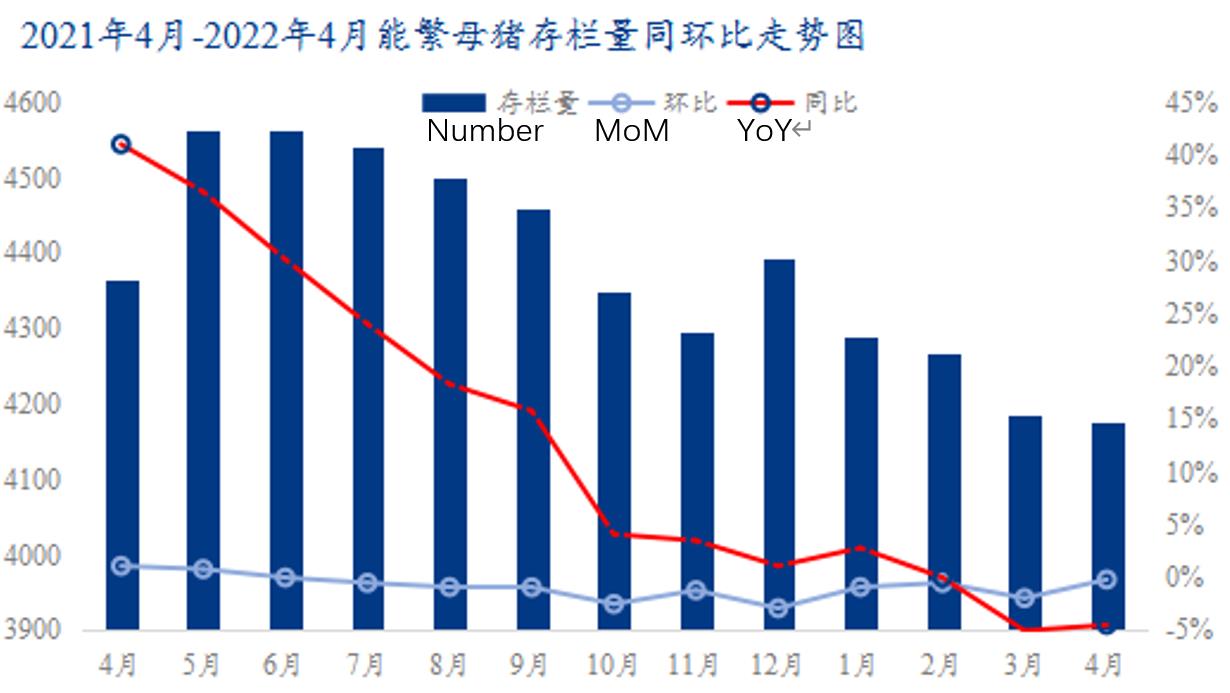

The pregnancy of breeding sows in June last year corresponds to the slaughter of commercial pigs in April this year. According to the monitored sales data, the pregnancy rate of breeding sows decreased in June last year, resulting in a decrease in commercial pigs.

2. Capacity release

Enterprises slow down it accordingly because April is the off-season for slaughter. The overall sales decreased in March (the off-season after the Spring Festival).

3. Cost

The breeding layout of enterprises is affected by feed prices. Small and medium-sized sow farms slow down the pregnancy scale and restocking speed.

4. Policy

The policy eased market conflicts. For example, Guangdong issued a ban on the transfer of pigs in April, which accelerated the transformation from pig transfer to meat transfer.

5. Pork collection and storage

The government completed four collections and storage and issued an early warning this month to resolve the breeding contradiction caused by low hog prices.

The listed pig enterprises reduced the slaughter volume to relieve business pressure. According to the research conducted by Mysteel on 141 enterprises, the slaughter plan in May was 2.65% lower than the actual completion rate in April. In addition to Hunan and Guangxi, which increased slightly, the number of other provinces decreased, while Henan and Shandong showed the most significant decrease, with a decline of 8.32% and 7.6%, respectively.

New Hope analyzes the overall hog price as relatively low this year because the hog price in the first half of the year was too low.

For example, around CNY 10-12/kg in March is below the average social cost line. The company plans to continue to reduce production capacity, and how to develop will be based on the information released by the state and obtained by the company.

Wen’s said their existing pig farm capacity is about 46 million, which can meet production planning. The company suspended the construction of new pig breeding farms. Its capital was mainly invested in convertible bond projects and unfinished projects under construction, focusing on pig breeding, slaughtering, and chicken breeding.

Can’t the giants hold on?

Some institutional investors believe most listed pig enterprises are “hanging in there” at the bottom of every pig cycle. Stabilizing capacity means getting the industry dividend first when a new round of the upward process comes. It may be considered as having problems in the capital chain if the company reduces production capacity. After all, expansion requires the ability to preserve assets.

The net assets of pig enterprises are insufficient due to long-term losses, and reducing production may be a helpless move. According to the first quarterly report, the net asset percentages of Zhengbang Technology, Aonong Bio, Tech-bank, Zhenghong and Kingsino all dropped to below 1%. The debt ratio of the top three enterprises exceeds 80%. All four companies have adopted a strategy of financing and reducing production.