According to data from the China Feed Industry Association, China’s total feed output in the first quarter of this year was 67.2 million tons, up 3.1% YOY and down 14.0% MOM, which was at a high level since 2018. Complete feed increased by 4.4% YOY, and concentrate and additive premix feed decreased by 12.4% and 7.3% YOY, respectively. All types of feed decreased MOM significantly.

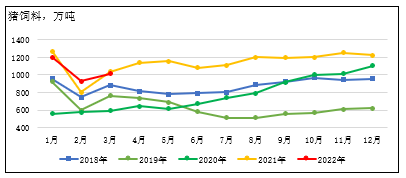

In the first quarter, the output for pig feed was 31.37 million tons, up 1.2% YOY. The China Feed Industry Association stated since January this year, pig feed ended 20 consecutive months of year-on-year growth, decreasing 5.1% and 2.2% in January and March, respectively (Except for the increase in February due to the Spring Festival). However, feed output remains at a record high and is still 21.4% higher than the same period in 2018 in the first quarter.

According to the association’s survey, high costs and epidemics have suppressed the demand for restocking and increased the enthusiasm for selling fattened stock. Pig farming, alternatively, has suffered deep losses, and farmers have significantly reduced feeding amounts to reduce losses.

For other feed types, the China Feed Industry Association judged that after the production capacity reduction in 2021, poultry feed would gradually adjust to a stable level this year. Both aquatic and ruminant feed will hold a pretty stable level. Overall, the total feed output in the first half of this year maintained a steady growth trend.

Raw materials prices

A hot topic in the feed industry has been the sharp rise in primary raw materials prices in recent years.

Due to the sporadic outbreaks of the Covid-19 pandemic in many places in China, the strict control measures affected corn transactions and transportation; the Russia-Ukraine conflict has also significantly increased the imported corn prices, even exceeding domestic corn prices. At the end of March, the quotation of imported corn reached CNY3,000 ($449.10)/ton.

According to China Feed Industry Association, the average purchase price of corn in the first quarter was CNY2,827 ($426.88)/ton, down 1.7% YOY. Since April, affected by the epidemic and farming losses, the purchase demand of feed enterprises has weakened, and the price of corn has fluctuated at a high level.

Soybean meal, which is mainly dependent on imports, the price has repeatedly hit new highs.

The dry weather in the soybean-producing areas of South America affected production, and the Russian-Ukrainian conflict led to the rise in crude oil prices, thus driving up international commodity prices, which increased the import cost.

In addition, the pandemic led to slow soybean unloading when arriving at the port. Oil plants have shut down due to a lack of soybeans, soybean meal inventories have remained low, and tight market supply continues.

The soybean meal price exceeded CNY 5,000 ($755.00)/ton this year. According to statistics, the average purchase price of soybean meal in China in the first quarter was CNY 4,223 ($637.67)/ton, up 13.0% YOY.

At a time when the international situation is complex and changeable, and the global epidemic is still severe, to ensure the supply of feed grains, the China Feed Industry Association recommends:

First, optimize the quota allocation of imported feed grains and the auction mechanism of stocking grains for feed production.

The quota for imported feed grains was suggested to be redistributed according to the annual statistical feed production proportion of feed enterprises with a particular scale and qualifications. This includes expanding the sales scale of stockpiled grain for feed production, reducing intermediate sectors, and feeding processing enterprises directly targeting stockpiled grain for feed production auctions.

Second, increase support and encourage the planting of feed grains.

Strengthen the protection of arable land, focus on the grain production, improve unit production yields, appropriately increase the planting subsidies, increase domestic feed grain production support, and encourage enterprises to plant crops in countries along the Belt and Road.

Third, strengthen the control of corn use.

The rapid expansion of corn deep processing capacity has exacerbated the contradiction between corn supply and demand. Enhancing the management of corn use, prioritizing the feed demand, and limiting industrial consumption are recommended.

Fourth, promote the orderly increase of imported grains.

Diversify the import channels of barley, sorghum, etc., increase the import volume of DDGS, rapeseed meal, cottonseed meal, sunflower meal, palm oil, and other by-products, and make full use of international market supply to stabilize prices.