The latest China pig industry data shows that the Chinese pig industry saw an overall decline in production performance in 2021 due to dramatic changes in breeding sow inventory indicators. However, the industry is expected to realize significant efficiency improvement in 2022 as the quality of sows improves.

Recently, Wepig Technology and several media and knowledge institutions, including Agripost.CN released the “Wepig Annual Benchmarking Report 2021”.

The data in this annual report came from 195 breeding farms across China, with a combined breeding sow stock of 156,000 head, of which Fujian and Guangdong provinces accounted for about 42%.

Statistics show that compared with the average production indicators of the past five years, one of the most apparent changes in China’s pig industry in 2021 is the sharp increase in the culling rate of breeding sows, reaching 62.3% for the year, with a peak of 111.1% in August, only to drop to the usual level in October.

Another stock indicator, the breeding percentage of gilts, declined by 4.2% to 31.5% in 2021. The abnormal changes in the stock have led to a decrease in the parturition rate. For example, the whole herd parturition rate was 72.63% last year, a decrease of almost 5% compared to 2020. And this is a significant parameter that affects the PSY.

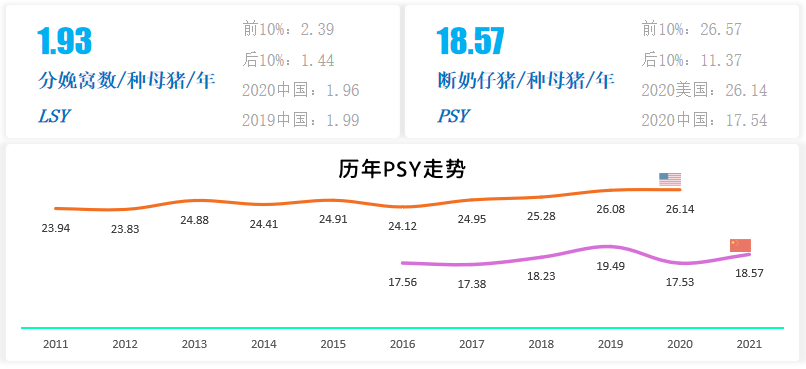

Compared with the US, a pig giant in the world, despite the gap in the starting point, the PSY indicator of China and the US both have shown an overall upward trend in recent years.

China has also experienced several fluctuations during this period, especially a significant decline in PSY in 2020. It is speculated that this may be related to the large number of commercial sows involved in production. In the future, as commercial sows are eliminated from the herd, and the overall sow quality rises, it is believed that we will see a significant efficiency improvement in 2022.

Its further analysis shows that the gap between China and the US in the pig industry is mainly in the efficiency of breeding and farrowing, where China has space for significant improvement in the future.

For more information, please contact with AgriPost.CN.