On January 3, Zhu Zengyong reported that in 2022 the average price of live pigs in China was CNY 19.0 /kg ($ 2.86/kg), which is lower than the previous year’s CNY 20.5 /kg ($2.97/kg). He predicts that in 2023, the pig prices will remain stable and rise only slightly as demand returns, contributing to a profitable sector by the year-end. Zhu Zengyong is the chief analyst of monitoring and early warning of the entire pork industry chain of the Ministry of Agriculture and Rural Affairs, and a researcher at the Beijing Institute of Animal Husbandry and Veterinary Medicine, Chinese Academy of Agricultural Sciences

Zhu Zengyong

His analysis revealed that, on the supply side, the inventory of breeding stock in China has picked up from the low level in April 2022, and by the fourth quarter, it was 900,000 higher than the maximum production capacity of 43 million heads. He predicts stability and a slight increase in China’s pork output in 2023 due to the increase in productivity (PSY performance) and the decrease in slaughter weight. Pork imports are also expected to rise to around 2 million tons.

On the consumption side, he predicts that pork consumption will surge from Q2, creating favorable conditions for pig prices, with support by lower Covid-19 infections, full recovery in catering and restaurants, and a 6% economic growth estimate for 2023.

He cautioned: “the current hog cycle is expected to have a shorter lifespan than previous ones. I expect the peak pig prices that appeared at certain points in 2023 will not outnumber that of the end of October 2022. Thus, the producers should focus on managing the current breeding stock and avoid impulsive expansion. Also, they should look out for the risk of loss during the Spring Festival sales season.”

2022 Market Review

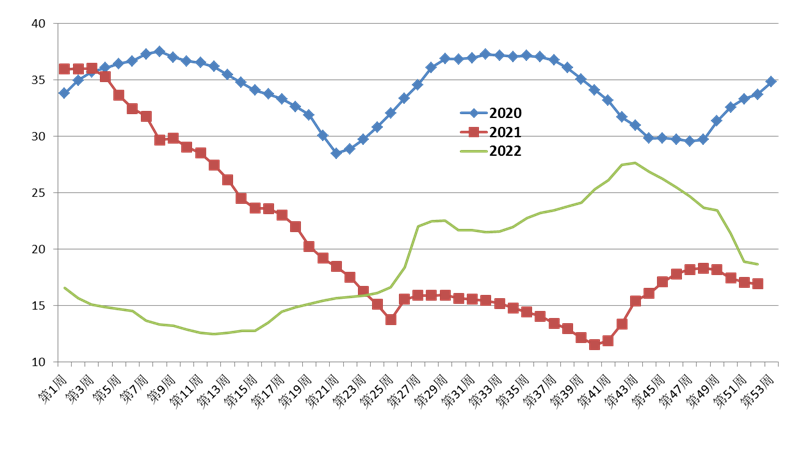

He also pointed out that the market sentiments played a significant role in the number of pigs sent to slaughter between the third and fourth quarters of 2022, resulting in a late boom in supply. The pig prices and profits got smacked by the decline in consumption and the increase in supply and dived at the end of the year. Since November 2022. the pig prices have crashed from CNY 28/kg ($4.07/kg) to CNY 17/kg ($2.47/kg), with the one-day plunge of CNY 1-2 (0.15-0.29).

Pig Prices by Week from 2020 to 2022 (CNY/kg)

“The first half of 2022 saw weak consumption and increased supply; in Q3, the decrease in supply and short-lived stimulation of consumption created a rebound in pig prices; the high pork prices combined with the spread of Covid led to a short-term depression of consumption towards the second half of fourth quarter,” said Zhu Zeng Yong.

On the whole, the producers that adopt the internal multiplication model were able to make profits for the fourth consecutive year in 2022 if not affected by the Pandemic, with an average profit of about CNY 300 ($43.53) per head, a slight decrease from last year.