China’s hog market is beginning to show signs of a rebound from the steep losses, as pig prices have continued to trend higher over the past two months, shifting the market’s focus to replenishment across the sector as it set the tone for prospects.

In a recent exchange with institutional investors, a few listed pig producers, including Wen’s Group, New Hope Group, and Haid Group, responded to this market concern.

Wen’s Group

Wen’s Group- the forerunner of operating with the model of “company + farmer”-pointed out that, on the supply side, household-based pig farmers primarily restock their herds by purchasing piglets reserved from the market for secondary fattening. This redistribution of piglets inventory will not affect the short-term supply of the sector. The overall production capacity and supply are more subjected to the increase of sow inventory, and there’s a long way to go from farrow to market.

According to Wen’s Group, the current level of profit margin is not attractive enough for small farmers, since the early input cost of swine producers is still higher with the new rebound in the pig price and no signs of easing in the feed raw material price. The small farmers are cautious to return to the business of raising pigs in the fear of huge market risk, tougher environmental protection regulations, and steep losses driven by the sluggish market in the past two years.

The family farm of Wen’s Group

New Hope Group

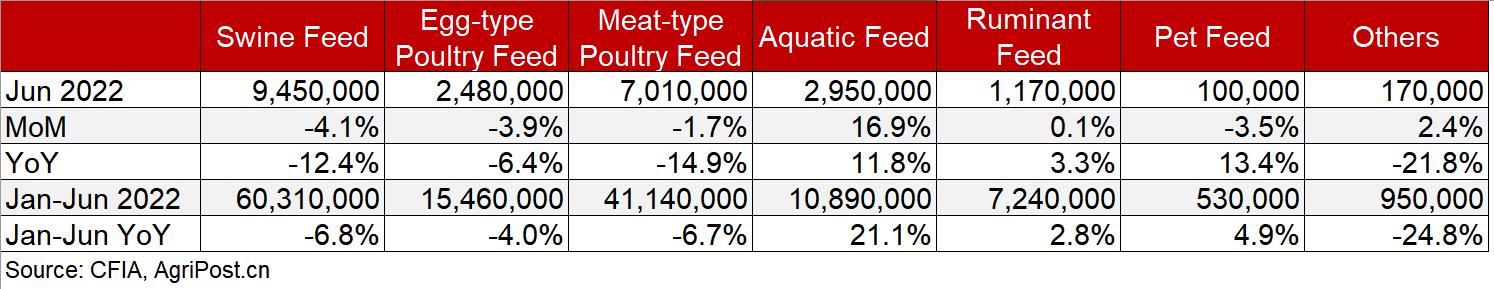

As the largest domestic or even global feed producer, the new hope looks at the market dynamics from the perspective of feed sales. The company pointed out that the sow feed sales, which are significantly lower than last year, have experienced a small extent of monthly from April, confirming the observation from the rural Ministry of Agriculture on the recent month-on-month increase in the breeding females. The sales of piglet feed are also on the month-on-month rise since May.

“Our company has visited several provinces to look into the herd’s replenishment across the industry. So far, the industry’s attitude towards restocking is generally neutral, not particularly positive. Some large or small and medium-sized producers don’t even have the capital to restock the herds.” The New Hope Group said.

New Hope Group also revealed that, based on the survey data, more than 50% of small farmers have left the business. For example, in Shandong Province, 70% of small farmers raising dozens of pigs have exited the pig business, and over half of the farms raising hundreds to 3,000 sows also chose to close business, “right now, the restocking across is penning at a slow pace. The number of producers that can afford to restock breeding sows is a lot smaller than the ones opting for secondary fattening and internal fattening.”

Haid Group

Another leading feed company, Haid Group, also pointed out that farmers are in no rush to restock the herd at present. It believes that, with the Covid-19 pandemic in China, the farmers are concerned that possible outbreaks could impact the circulation of pork products and sales channels.