On April 17, Pandairy, a leading player in China’s condensed milk sector, announced its 2021 annual report. Despite revenue exceeding CNY 800 million(USD 124.42 million) in 2021, net profit for the same period was CNY 77.35 million (USD 12.03 million). That is down 5.11% year-on-year, which Pandairy attributed to government subsidy cuts.

In 2020, Pandairy was officially listed on a stock exchange. The government subsidies received by Pandairy that year also reached a record high. According to the 2020 annual report, government subsidies included in current profit and loss amounted to CNY 23.91 million (USD 3.72 million), accounting for 29.3% of the current net profit. The following year Pandairy received a record low of CNY 3.24 million (USD 0.5million) in government grants included in current profit and loss, a plunge of almost CNY 20 million (USD 3.11 million) compared to 2020.

Rising costs led to a decline in Pandairy’s central business gross margin

According to the annual report, the direct materials, direct labor, and manufacturing costs of concentrated dairy products, the core business of Pandairy, increased by 25.21%, 25.63%, and 10.38%, respectively year-on-year in 2021. As a result of these factors, the gross margin of the dairy concentrate business was 31.07% for the same period, down 3.25% year-over-year. Pandairy eventually chose to raise prices to cope with the rising costs. Some industry sources believe that the main reason for the decline in the gross profit margin of Pandairy’s core products is the increasing cost of raw materials, so choosing to reduce costs and increase efficiency is a good strategy for a long rainbow performance.

Pandairy previously involved with two food safety violations

Market regulators have notified Pandairy twice in the last two years of food safety issues. On December 23, 2020, the Shanghai Market Supervision Bureau released the 48th provincial food safety sampling information for 2020. It showed that its food products exceeded the total bacterial count standard. The following April, the Guangdong Provincial Market Supervision Administration notified it that its total bacterial count did not meet the national food safety standard provisions.

Pandairy risks have a relatively single product range; layout of the cheese business is still challenging

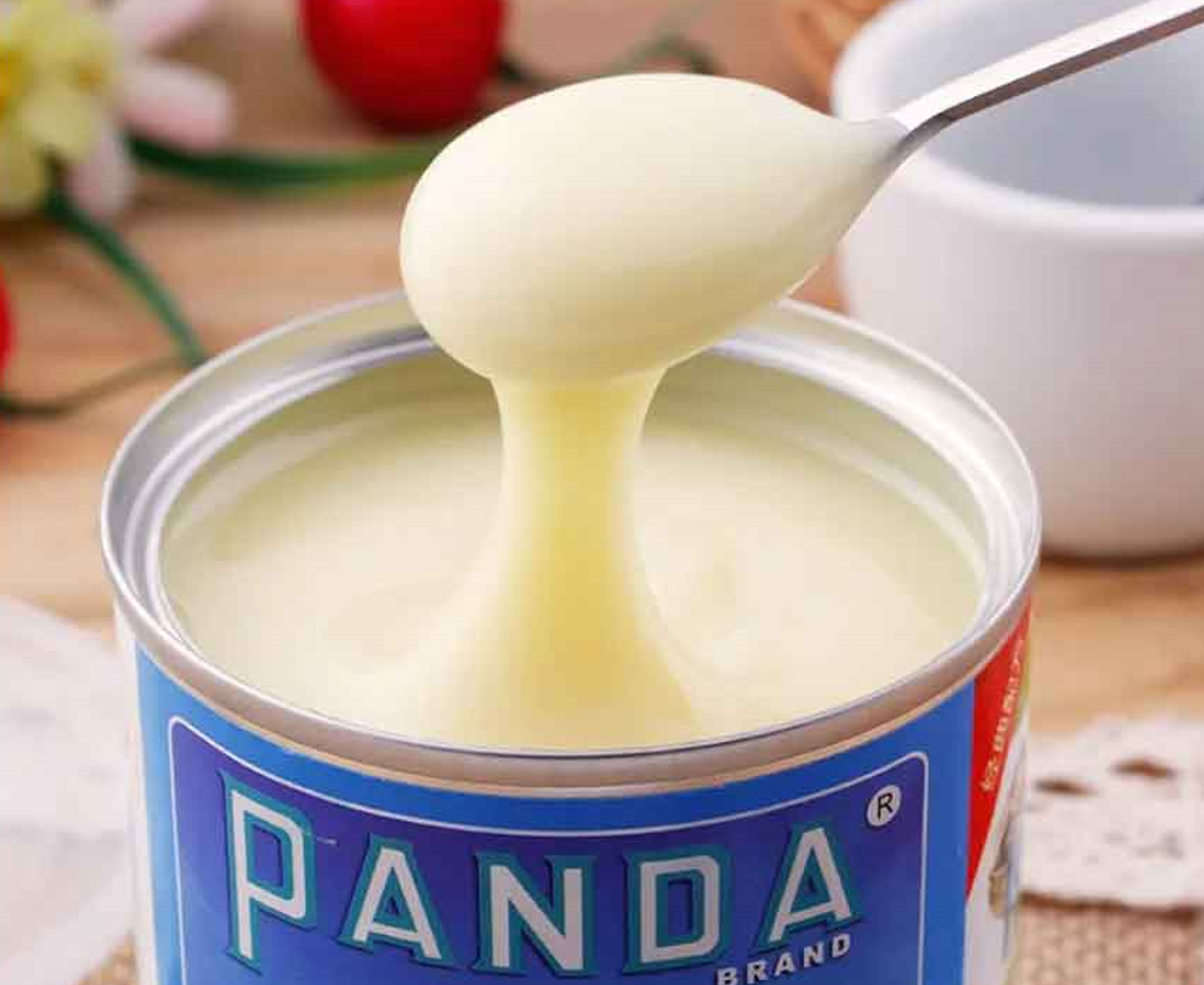

Due to the over-focus on the condensed milk business, Pandairy also risks having a relatively single product range. The data shows that from 2017-to 2021, the sales revenue of condensed milk products business accounted for 67.95%, 75.15%, 72.03%, 64.18%, and 63.20% of Pandairy’s primary business revenue, respectively. Although the proportion has decreased in the last three years, it still exceeds 60%.

In the 2021 annual report, Pandairy also stated that the company’s main product is condensed milk. Suppose the market size of condensed milk products shrinks, the price of condensed milk products decreases or the company cannot maintain its current market share. In that case, it will adversely affect the size of the company’s revenue. Therefore, Pandairy made great efforts to lay out the cheese business.

Pandairy established a Cheese Division responsible for promoting and selling cheese and other new products in various fields in 2018. That same year, the Shandong processor was put into production. In 2021, Pandairy mentioned that it would build some infrastructure based on cheese sticks in the next two years. Retail leisure cheese would be the company’s essential layout products in the future.

However, the cheese market has both potential and competition, with the dominant position held by Milkana and Milkground and the presence of senior brands such as Anchor and Kraft and nascent brands such as Dr. Cheese and Milkfly. Industry stakeholders pointed out that: on the one hand, the cheese market is in the growth period, but demand is still limited; even if Pandairy continues to make efforts to develop the market, it is difficult to achieve better results in the short term, on the other hand, Pandairy is weak in brand promotion and marketing, in the face of increasingly fierce competition in the market is challenging to gain an advantage.