Guangxi Yangxiang IPO plans: Increasing last year’s $600 Mln profit and intending to raise $1.61 Bln for pig raising and related industries’ development

Guangxi Yangxiang Co., Ltd. recently pre-disclosed the prospectus on the China Securities Regulatory Commission website. It detailed their plans, to list on the Shenzhen Stock Exchange mainboard, for raising approximately CNY 10.4 Bln ($1.61 Bln) to invest in pig raising and related extension industries. These include breeding and commercial pigs, semen, feed and feed processing, along with other related fields.

Yangxiang Company, founded in 1998, was mainly engaged in feed production and sales at the initial stage. They extended downstream in 2004 to the pig raising-related business. At present, the company’s main business includes pig raising and feed, among which includes breeding, feeding, commercial piglets, semen and feed products throughout the pig’s lifecycle.

In 2020, Yangxiang produced about 2.14 million pigs, including 293,000 breeding pigs and 117,000 commercial piglets. They also produced 1.73 million tons of feed and sold nearly 5.84 million bags of 80 mL fresh pig semen.

Yangxiang achieved an operating income of CNY 13.1 Bln ($2.02 Bln) last year, more than double that of 2019. Its net profit belongs to shareholders of the parent company soared from more than CNY 45 Mln ($ 6.95 Mln) to more than CNY 3.9 Bln ($ 600 Mln).

In its 2020 income, pig raising and feed accounted for 76.45% and 23.41% respectively, of which feeding and breeding pigs and semen accounted for 56.55%, 15.96% and 2.82%, respectively.

Yangxiang’s top two customers last year were New Hope and Wens, both of which were breeding pigs purchasing, involving CNY 1.18 Bln ($118 Mln) and CNY 380 Mln ($58.82 Mln) respectively.

By the end of 2020, Yangxiang had about 170,000 breeding pigs (including sows and boars) and nearly 210,000 replacement pigs. The company said in the next few years, it will expand the scale of breeding steadily, upgrade from traditional pig farming to scientific pig farming. From there, they will upgrade to internet pig farming and build an industrial internet technology food company vertically integrated with feed, pig raising, slaughtering and sale.

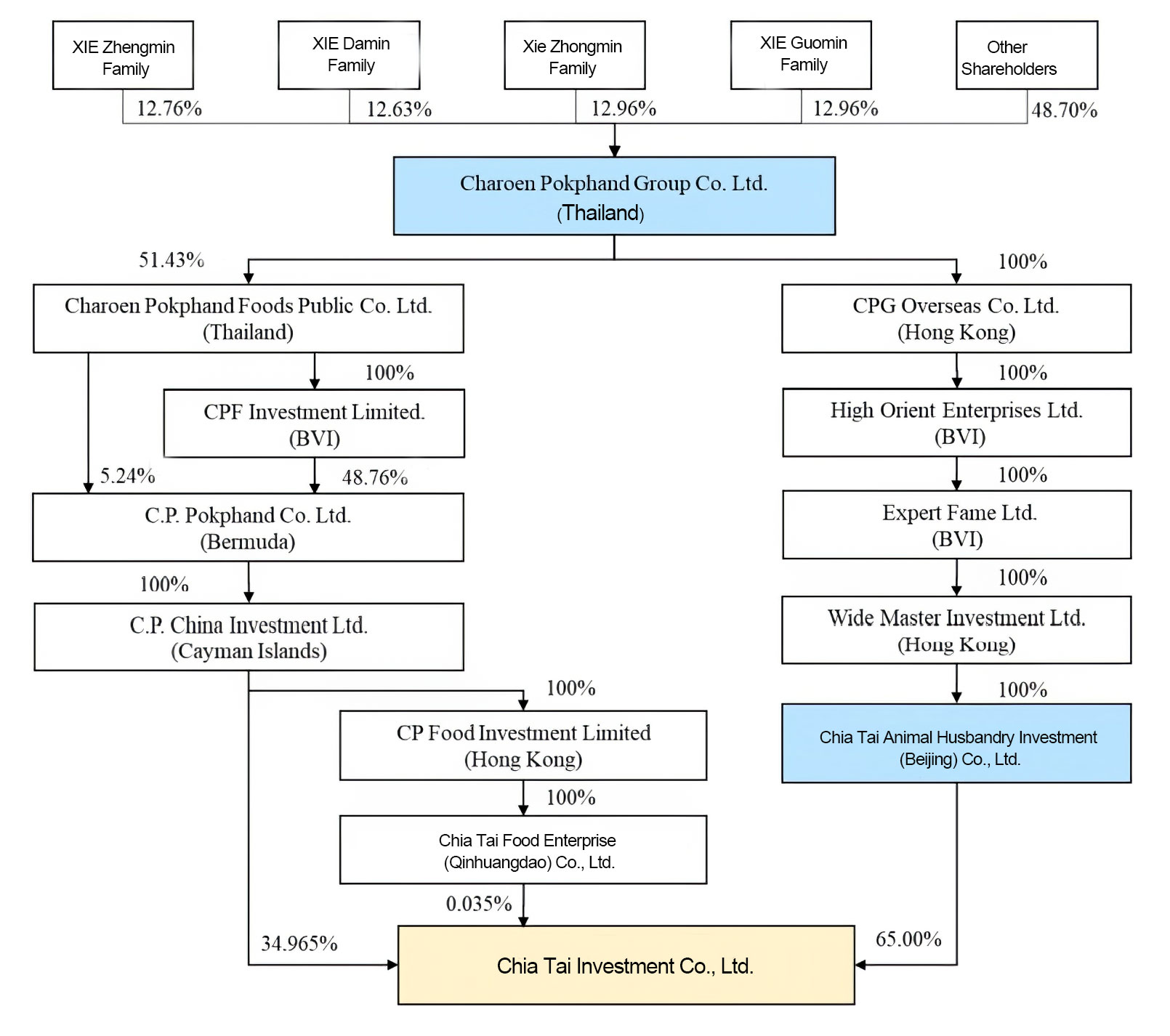

Shareholding structure

From the perspective of shareholding structure, its five directors, Yang Xiang, Shi Liang, Mo Jinzhi, Zhang Conglin and Yang Yuewu, directly and indirectly, hold 74.54% of the voting rights (including employee stock ownership plan) of the company, which are the actual controllers of the company.

The Central Enterprise Poverty-stricken Industrial Investment Fund Co., Ltd. and the Education Development Foundation of Huazhong Agricultural University also hold 3% and 2% of the equity in Yangxiang, respectively. In addition, Continental Capital Co., Ltd. through Conti Feed Additives (Beijing)Co., Ltd. and Conti Feed (Tianjin) Ltd each hold 1.32% of the shares.

AgriPost.CN is an animal protein community connecting China and the world and a partner of global agribusiness media such as Misset and Asian Agribiz. Our co-founder & managing editor, Allen Shu, is a correspondent for Misset’s Pig Progress magazine in China. (contact@agripost.cn)