ST Aonong Group has completed a significant corporate restructuring, leading to changes in its board of directors and ownership structure. Founder Wu Youlin has resigned as chairman but remains vice-chairman and CEO. Su Mingcheng, from the new controlling consortium led by Quanzhou Development Group, has assumed the chairman role. The restructuring diluted the holdings of Wu and other previous stakeholders, while the new investor group now holds a combined 15.65% share. Aonong expects to recover from losses with projected net profits of up to CNY 700 million in 2024, driven by debt restructuring and operational scale adjustments. The company aims to focus on core feed production, optimize hog farming with asset disposal and new partnerships, and expand its food processing segment by leveraging investor resources.

China-based ST Aonong Group has announced changes to its leadership structure as part of a corporate restructuring plan. Wu Youlin, the company’s founder and former controlling stakeholder, has stepped down as board chairman but will continue to serve as vice-chairman and CEO. His resignation paves the way for a new phase of leadership, with the board term spanning from January 2024 to January 2027.

Taking over the chairman role is Su Mingcheng, a representative of Aonong’s new majority ownership group—a consortium of industrial investors led by Quanzhou Development Group. Born in 1984, Su is currently a vice-general manager at Quanzhou Development Group.

Su Mingcheng

In the reshuffle, four non-independent directors from key investors have been appointed to the board. The appointments include two from Quanzhou Development Group, and one each from Hubei Grain Company and Xiamen Guweide Foods. Meanwhile, two long-time non-independent directors, Yang Zhou and Kuang Jun, have resigned. Yang retains his position as deputy CEO and CFO, while Kuang’s future role remains uncertain.

Aonong’s board now includes representatives from both its pre-restructuring stakeholders and new investors. Wu Youlin and Cai Jiangfu, chairman of Zhangzhou Jintou Group, represent existing shareholders.

Yu Daojin

Significant updates have also been made to Aonong’s independent board members, particularly with the addition of Professor Yu Daojin of Fujian Agriculture and Forestry University. Yu, a specialist in pig disease prevention, replaces aquatic nutrition expert Professor Ai Chunxiang of Xiamen University.

Ownership transformation

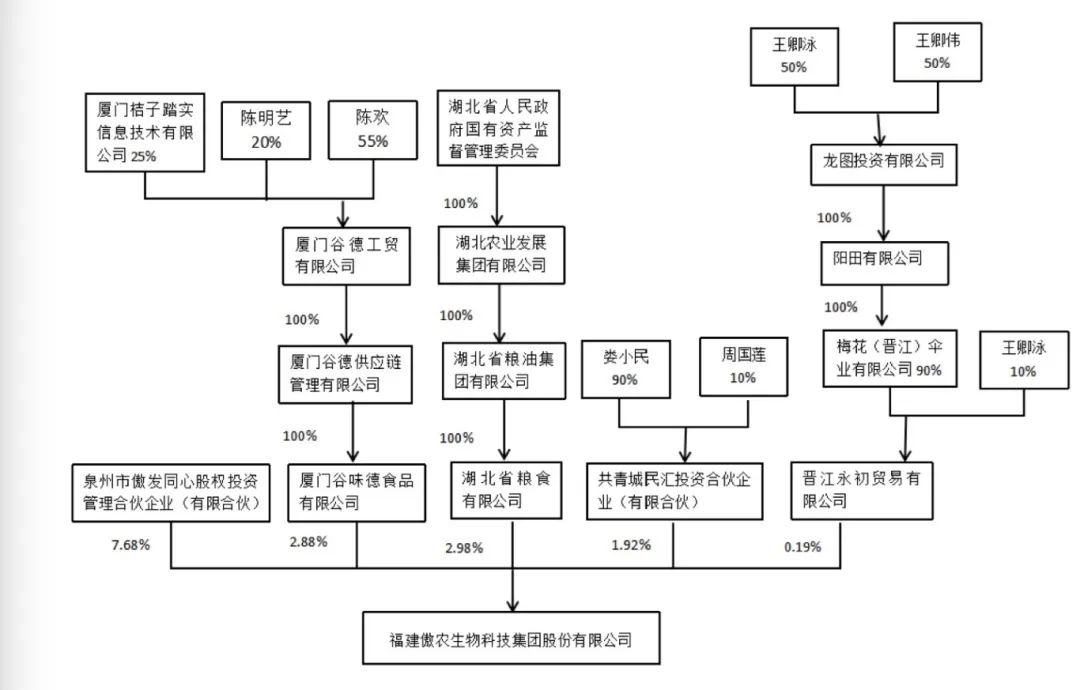

Following the restructuring, control of Aonong has shifted from Zhangzhou Aonong Investment Co. to the new investor consortium, making the company officially ownerless in terms of a controlling shareholder. The consortium comprises five major partners, including Quanzhou Development Group, which holds 7.68%—nearly half of the total 15.65% stake. Other members include entities such as Hubei Grain Company and Xiamen Guweide Foods.

Wu Youlin’s stake and aligned shareholders have decreased from 45.25% to 14.58%. Similarly, Zhangzhou Jintou Group’s shareholding has been diluted to around 3%. Among the financial investors brought in through the restructuring process, China Foreign Economic and Trade Trust Co., under the control of state-owned Sinochem, has emerged with a 7.98% stake.

Profitability forecast amid operational adjustments

Despite reporting a loss of CNY 3.65 billion (~USD 484 million) in 2023, Aonong projects a significant turnaround with a net profit of 5 CNY 00 to 700 million (~USD 66–93 million) in 2024. The company expects to generate between CNY 8 and 9 billion (~USD 1.06–1.2 billion) in revenue, improving its net asset position to CNY 2.5 to 3 billion (~USD 331–397 million).

A key driver of this anticipated recovery is Aonong’s debt-to-equity conversion plan, which will likely add CNY 2.4 to 2.8 billion (~USD 318–371 million) to earnings. However, restructuring has led to a significant contraction in operational scale, with feed sales dropping 37% year-on-year to 1.7 million tonnes and live hog production plummeting 64% to just over 2 million head.

Strategic focus for the future

In its restructuring blueprint, Aonong highlights a strategic pivot towards feed production as the foundation of its business model, with hog farming and food processing serving as complementary pillars. The company aims to enhance supply chain efficiency, reduce costs, and improve feed profitability, particularly in core markets like Fujian and Jiangxi.

On the hog farming front, Aonong plans to dispose of underperforming assets, exit northern markets, and shift to a hybrid model combining self-breeding and partnerships with contract farmers. This adaptive strategy will allow the company to dynamically adjust production in response to market demand, thereby strengthening risk management.

The food processing segment is positioned for expansion, leveraging the company’s regional slaughterhouse licenses and synergies with internal hog production to maximize capacity and profitability. Aonong also aims to scale up the business by tapping into its investors’ extensive distribution networks.

Reflecting on past lessons, Aonong acknowledges the pitfalls of its prior aggressive expansion, particularly in hog farming. Going forward, the company is committed to a steady, high-quality growth strategy anchored in vertical integration and balanced diversification.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.