Wens VP Qin Kaitian said extending the yellow-broiler chain hinges on R&D and marketing as Wens shifts to a “farming + food” model . With 1.2bn birds still sold 83% live/16% fresh/1% prepared, the focus is branded chilled products, lifestyle-ready SKUs, culture-led marketing, and full-chain ops built on fast response, 100 km farm–plant layout, strict plan-to-contract, and a transfer price plus performance-based profit adjustment.

At the 2025 Meat & Poultry Industry Development Conference, Qin Kaitian, vice president and board member of Wens (Wens Foodstuff Group Co., Ltd.), set out a simple thesis: moving up the value chain in yellow broilers will be won by better R&D and sharper marketing. And once you run the whole chain, execution is about “fast response, less internal friction.”

Qin Kaitian

From “farming + food” to branded demand

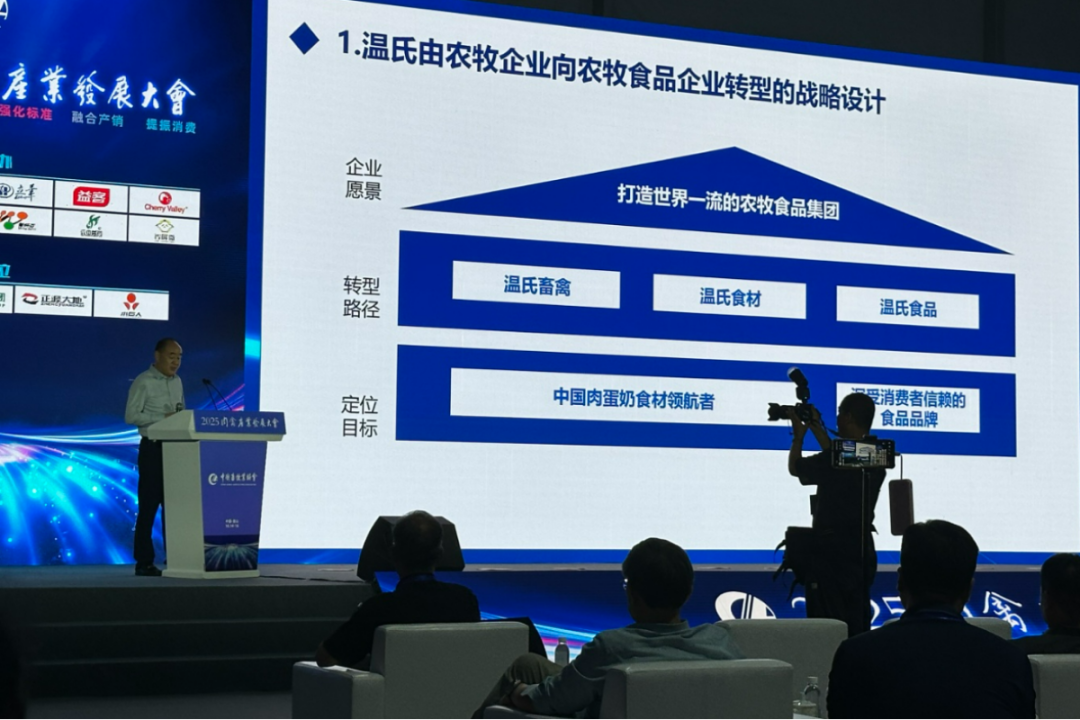

To match shifting consumption, Wens is accelerating its transition from a pure agri-livestock company to an agri-food player, pushing a “farming + food” dual-engine model. The company will consolidate its farming base while steadily lengthening the chain—building Wens Ingredients and Wens Foods brands on top of its livestock and poultry portfolio.

Wens has sited slaughterhouses and food plants in its three core consumption regions—South China, East China, and Central China—with slaughter capacity of about 350 million birds, and prepared-foods capacity of roughly 40,000 tonnes. Even so, in Wens’ about 1.2 billion broilers marketed annually, 83% are still sold as live birds, with fresh at 16% and prepared foods at 1%.

Qin’s view: to truly extend the chain, R&D and marketing are the next battlegrounds. On products and supply chain, the industry needs to tackle both policy and convenience head-on. For example, building branded chilled meat systems will require market education—popularising the technical benefits of chilled processing, sharing taste-test comparisons—plus end-market sampling to shift the entrenched belief that “only on-the-spot slaughter is fresh,” and to build trust in branded chilled products.

Beyond whole birds: products for modern life, marketing with culture

Product formats also need to move past whole birds and large cuts, with more SKUs built for modern lifestyles. On the brand side, Qin argues for deeper culture- and value-led marketing, amplifying core advantages to support premium positioning. Recent attempts by several leading yellow-broiler companies—such as the “Great Wall Night Banquet” concept that blends “Guochao” (national-trend) cues with regional culture—are examples Qin cites as the kind of experimentation the category needs.

Full-chain operations: speed up, waste less

With full-chain operations underway, Qin says the priority is operational cadence: respond fast, cut internal drag.

- Capacity layout, in sync. Farming should be planned around slaughter, and prepared-foods processing should sit close to slaughter. At Wens, farming clusters are typically within a 100 km radius of slaughterhouses to reduce transport loss and stress, enabling fast response and tighter supply-chain synchrony. Keeping prepared-foods plants adjacent to slaughter helps lock in flavour and nutrition, shorten cycle time, and slash logistics and shrink costs.

- Plan-to-contract discipline. Farming and processing units must execute against pre-agreed varieties, volumes, and timing. Disputes are escalated for group-level adjudication, and violations are handled strictly, to keep the chain aligned.

- Sharing margins fairly upstream and down. Yellow-broiler slaughter is still a young segment, and farm-gate pricing can’t yet be fully market-based. Wens has therefore adopted a “transfer price + performance-based profit adjustment” mechanism. First, an annual baseline transfer price is set on a “standard cost + reasonable profit” basis. Then, if the transfer price diverges from the external market, a profit-adjustment is calculated for both supply and procurement sides to reflect the price gap.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.