COFCO Joycome acquired a deep-processing plant in Pinghu, Zhejiang—widely understood to be Danish Crown’s former site—which Danish Crown decided to shutter after a strategic review. Local filings show COFCO’s new “Maverick” project matches the site’s original land, capacity, and address. Danish Crown had banked on an Alibaba-linked sales channel via Win-Chain, alongside Alibaba’s five-year USD 200 billion import pledge and Win-Chain’s “40+50+100” sourcing plan, but Win-Chain later entered court-led restructuring. Joycome’s H1 2025 results were strong: revenue up 19.8% (CNY 8.96 bn), profit swing to positive, hog marketing up 83.0% (2.90 m head), branded boxed pork up 46.5% (brand share 31.2%), and linseed-fed, antibiotic-free pork up 123%. With Pinghu and Dongtai Phase II, processed-meat capacity is set to rise from 23,000 t/year to 52,000 t/year.

COFCO Joycome has quietly picked up a ready-made foothold in East China’s processed meats space. In its 2025 interim results, the Hong Kong–listed company said that in July it acquired a deep-processing plant in Pinghu, Jiaxing, Zhejiang, with an annual capacity of 9,000 tonnes. Linked to Joycome’s Shanghai R&D centre, the site is meant to respond faster to demand in the Yangtze River Delta and surrounding markets.

Multiple independent sources checked by AgriPost.CN indicate the asset is the same Pinghu facility that global meatpacker Danish Crown decided to cease operating earlier this year. At the end of February 2025, Danish Crown announced on its website that following a strategic review it would stop operations in Pinghu, a move that could affect 112 jobs. The plant opened in 2019 as Danish Crown’s first production base in China, focused on fresh meat portioning and branded products like bacon and sausages, with an on-site R&D centre.

“We prefer to divest the business and have signed a letter of intent with a preferred buyer, agreeing the terms of a carve-out,” said Chief Financial Officer Anders Aakær Jensen, Danish Crown, at the time. “Although the negotiations are going well, we still expect it will take a few months to complete.”

Same address, same metrics

The Pinghu Municipal People’s Government disclosed in early July that, on June 30, the COFCO Maverick Pinghu project signed into Pinghu Economic & Technological Development Zone. The project shows registered capital of CNY 50 million (USD 6.96 million), land of 36.8 mu (≈2.45 ha), and designed output of 14,000 t/year with annual output value above CNY 500 million (USD 69.64 million).

Notably, those figures—36.8 mu(≈2.45 ha), 14,000 t/year, and >CNY 500 million—mirror the headline metrics that local authorities previously used to describe Danish Crown’s Pinghu operation.

Business registration records add another breadcrumb: COFCO Maverick Food (Pinghu) Co., Ltd. was incorporated on June 19, 2025, at No. 1288 Xinming Road, Zhongdai Sub-district, Pinghu, the same address as Danish Crown’s entity. Also on June 19, Danish Crown’s China unit moved its registered address to an office location elsewhere in Pinghu and lifted its registered capital by CNY 240 million (USD 33.43 million) to CNY 909 million (USD 126.60 million). The purchase price for Joycome’s acquisition has not been disclosed.

Danish Crown’s China ambition—and a sales pivot that faltered

When Pinghu opened, local reports cited Danish Crown’s roots back to 1887, calling it Europe’s largest meat processor and the world’s largest pork exporter, with roughly 85% of pork sold into international markets. Group sales were put at about CNY 60 billion (USD 8.36 billion), of which China accounted for roughly CNY 5 billion (USD 696.37 million).

Back in 2019, Pinghu was pitched as Danish Crown’s beachhead to move up the value chain in China—from raw material supplier to food processor and brand owner. “We are further developing our value chain in China, which holds tremendous potential,” said Chief Executive Officer Jais Valeur, Danish Crown, when the project was launched.

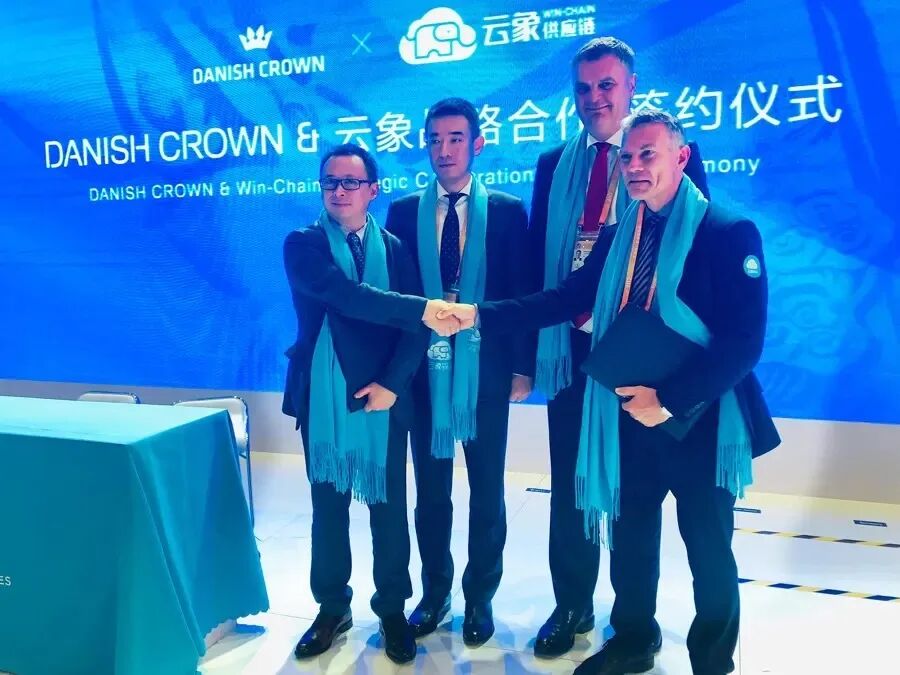

To build routes to market, Danish Crown signed a strategic agreement at the first China International Import Expo in November 2018 with Win-Chain Supply Chain, the group purchasing platform in Alibaba’s fresh supply chain ecosystem. Win-Chain committed to procure USD 400 million worth of fresh products over five years, and Pinghu’s output was to flow through that channel—much of it expected to reach consumers via Alibaba’s Hema Fresh.

At that same expo, Alibaba also announced a USD 200 billion import plan over five years leveraging its digital economy. Within that framework, Win-Chain set a “40+50+100” target: strategic partnerships with 40 origin countries, 50 production regions, and 100 top global suppliers.

The plan ran into trouble. Court records from the Shanghai No. 3 Intermediate People’s Court show Win-Chain’s parent group applied for restructuring in July 2020 amid a failed business pivot; in November 2020, the court ruled for substantive consolidated restructuring of three related debtors, and approved the reorganisation plan in February 2021. Against that backdrop—and after what Danish Crown called “continued challenges” and underperformance versus profitability expectations—Pinghu ended up on the block.

Joycome’s mid-year: hogs up 83%, fresh pork mix improving

For COFCO Joycome, the Pinghu acquisition lands in a stronger half-year. In January–June 2025, Joycome reported revenue up 19.8% year-on-year to CNY 8.96 billion (USD 1.25 billion). Profit before fair value adjustments on biological assets swung from a CNY 322 million (USD 44.85 million) loss a year earlier to a CNY 198 million (USD 27.57 million) profit.

Hog marketing surged 83.0% to 2.90 million head. In fresh pork, branded boxed pork volume rose 46.5%, taking brand share within fresh back to 31.2%. Joycome said its hog unit drove cost down through herd rotation and reproductive efficiency, scaling contract farming (“company + farmer”), and tightening on FCR, feeding, vaccines/drugs, and frontline incentives to narrow regional gaps.

On product, the company doubled down on linseed-fed, antibiotic-free pork as its premium core, pushed via e-commerce. “With consistent quality and stable supply, platform stickiness increased; linseed pork volume rose 123% year-on-year in H1,” Joycome noted.

Joycome currently runs four slaughter and processing bases in Jiangsu, Hubei, Jilin, and Inner Mongolia, plus cutting centres in Guangdong and Beijing, serving major consumption regions such as Beijing, Shanghai and the Yangtze River Delta, Guangdong, Hubei, Jilin, and Inner Mongolia. Total fresh pork sales reached 150,000 t, up 25.1% year-on-year.

In processed meats, COFCO Joycome already operates modern plants in Jiangsu and Guangdong under the “Maverick” and “Joycome” brands, mainly mid- to high-end chilled items like sausages, bacon, and ham. Beyond the Pinghu deal, Dongtai Phase II in Jiangsu is slated to start up by end-2025, taking the segment’s laid-out capacity from 23,000 t/year to 52,000 t/year.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.