Sunner Development’s Jan–Sep 2025 revenue reached CNY 14.706 billion (+6.86%) and net profit CNY 1.16 billion (+202.82%), driven by a richer product mix, firm pricing, cost gains, and the Sun Valley consolidation; deep-processed foods neared 50% of sales as C-end retail rose 30%+, exports 40%+, and the in-house “Shengze 901Plus” improved FCR and lowered costs; integrated capacity is about800 million birds with >500,000 t ready-to-eat, 12 food plants since 2017, 2024 food revenue >CNY 8 billion, and C-end sales about CNY 2 billion in 2024, aiming about CNY 3 billion in 2025.

On October 22, 2025, Sunner Group (Sunner) released its third-quarter report: revenue reached CNY 14.71 billion (USD 2.05 billion) for January–September, up 6.86% year-on-year; net profit attributable to shareholders came in at CNY 1.16 billion (USD 161.40 million), up 202.82%. Part of the lift came from consolidating Sun Valley after gaining control during the period. The company also credited a steadily improved sales mix and more resilient pricing on the one hand, and a firmer cost advantage on the other.

Sunner said all major business lines grew steadily in volume in the first nine months, with deep-processed products continuing to gain share. A full-channel strategy underpinned outperformance: consumer retail (C-end) grew by more than 30% year-on-year, exports rose by over 40%, and foodservice also posted solid gains across segments.

Internally, the new generation self-developed breeder line “Shengze 901Plus” continued to improve on key metrics such as feed conversion ratio (FCR), and its share in Sunner’s own flocks kept rising. Coupled with ongoing lean management initiatives, the company’s composite cost of producing meat fell year-on-year in January–September 2025. At a first-half results briefing, management disclosed that H1 comprehensive meat-production cost was down by more than 10% versus the prior year, while C-end revenue share had climbed to about 15%.

“Faster C-end growth is the result of online–offline teamwork,” Sunner noted. “We went all-in on content e-commerce, membership warehouse clubs, and snack-store channels. With strong product R&D and a sharp read on taste trends, we hit the goals set at the start of the year.”

From farming champion to food major

At the 2025 Meat & Poultry Industry Development Conference in Kunshan, Jiangsu, Liao Junjie, deputy general manager and board secretary of Sunner, laid out how the company moved from a white broiler farming leader to a food company. Over more than 40 years, Sunner has built what it describes as the world’s most complete white broiler chain—self-breeding, self-multiplication, self-rearing, self-slaughtering, and deep processing—now with integrated capacity approaching 800 million birds, and more than 500,000 t of ready-to-eat capacity per year, topping the global league on integrated scale.

Liao Junjie

Scale accelerated after Sunner listed in Shenzhen in 2009. From 2009 to 2017, farming capacity grew from 50 million to 500 million birds, cementing its position as a white broiler leader. After the white broiler cycle peaked in 2011, the industry endured a seven- to eight-year winter. Sunner, however, continued to expand against the tide until the next upswing arrived—“picking the right direction matters most,” said Liao.

Food then became the main thrust. In 2017, Sunner folded the group’s deep-processing unit into the listed company, leveraging capital markets to build 12 food plants in under a decade. Food revenue surpassed CNY 8.00 billion (USD 1.11 billion) in 2024, with a compound annual growth rate above 20%.

Breeding-led cost edge, digital backbone

Alongside its food push, Sunner pivoted from pure scale to fine-tuned operations, targeting the lowest possible cost per kilogram. Profit, Liao argued, is fundamental to ready-to-eat: it funds channel development and R&D, enabling products that match consumer preference and, crucially, can be produced at low cost at scale.

He credited the company’s self-developed breeder lines—“Shengze 901,” launched in 2021, and the latest “Shengze 901Plus”—as the biggest contributors to cost decline. Own genetics make planning controllable, allow the chain to run at or above full load to dilute fixed cost, and keep performance improving to structurally lower farming cost.

At the conference’s white broiler forum, Luo Pingtao, president of Fujian Shengze Biotechnology Co., Ltd., reported performance at Sunner’s Zhenghe base: by September 2025, market age had fallen from 38.80 days (2021) to 36.39 days; survival improved from 94.3% to 95.87%; and FCR improved from 1.63 to 1.51.

Luo Pingtao

Liao Junjie also stressed that food safety is a lifeline; Sunner’s chain is designed for prevention, control, and traceability—one reason the company has always insisted on full-chain integration. The firm completed end-to-end digitalisation last year.

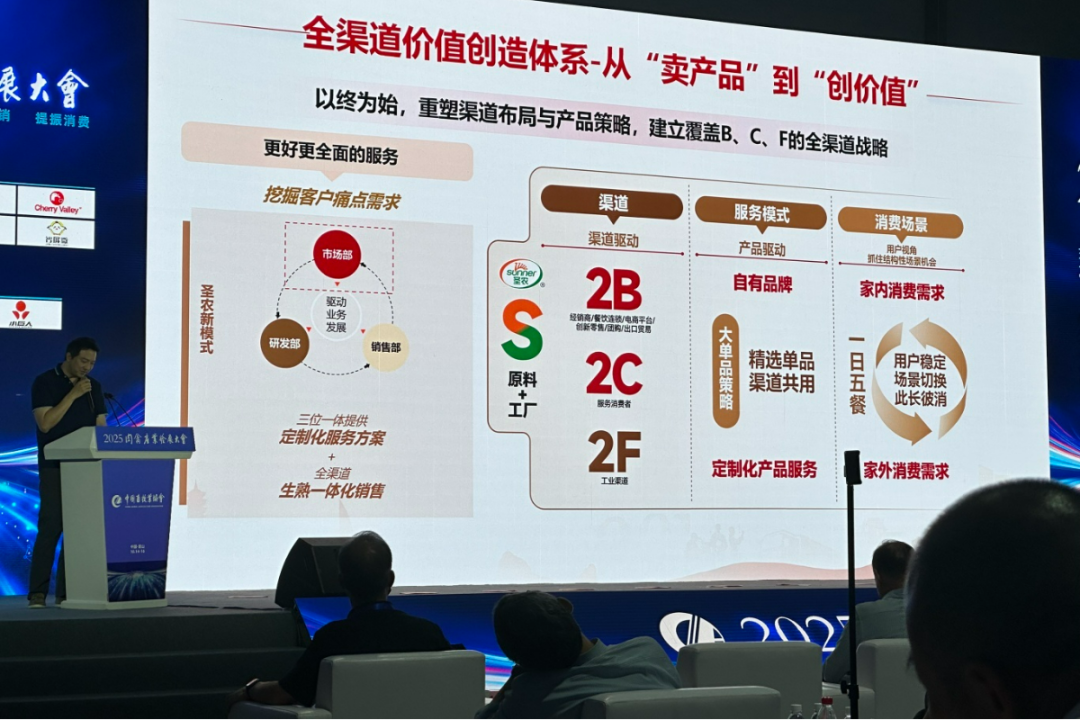

Selling value, not just product

On the go-to-market side, Liao called for a mindset shift from “selling products” to “creating value,” pinpointing customer pain points and offering fuller service. Beyond sales and R&D, Sunner now brings marketing into a “three-in-one” client-service model. Marketing helps clients mine the data they need—real-time trends in restaurant openings and ticket sizes, ingredient usage shares in foodservice, high-growth lanes in retail, and more.

For C-end, the company designs formats to fit usage scenarios—meeting structural opportunities in at-home and out-of-home occasions that shift in share but remain stable in total. As of now, deep-processed foods account for nearly 50% of Sunner’s revenue. High-value channels such as C-end retail and foodservice together make up 60% of sales. The C-end business delivered around CNY 2.00 billion (USD 278.55 million) last year and is on track for roughly CNY 3.00 billion (USD 418.94 million) this year.

Sunner’s playbook, Liao concluded: build on a full industry chain, defend with homegrown genetics and cost control, and drive B- and C-end growth through an all-channel layout—completing the strategic step-up from agri-livestock to food.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.