Zhengbang Technology’s subsidiary Chaoyang Zhengbang Ecological Agriculture has entered pre-reorganisation after a court ruling in Liaoning Province. Saddled with CNY 470 million (USD 65.46 million) in debt, the company could receive support from Shuangbaotai Group, which already led Zhengbang’s own turnaround. If successful, the process could revive Chaoyang Zhengbang’s four pig farms and lift its annual output value above CNY 3 billion (USD 417.83 million).

On July 29, Zhengbang Technology disclosed that its subsidiary, Chaoyang Zhengbang Ecological Agriculture Co. (Chaoyang Zhengbang), has had a creditor’s petition for pre-reorganisation accepted by the Chaoyang Intermediate People’s Court in Liaoning Province. The ruling, issued on July 25, followed a petition from creditor Zhang Xiuchun, who argued that the company was unable to repay debts but retained high restructuring potential.

Chaoyang Zhengbang, founded in May 2020 with a registered capital of CNY 250 million (about USD 34.82 million), is wholly owned by Jiamei (Beijing) Breeding Technology Co., itself a subsidiary of Jiangxi Zhengbang Biotechnology Co., under Zhengbang Technology. The company operates four pig farms and is reportedly saddled with liabilities of CNY 470 million (about USD 65.46 million).

Second court intervention within six months

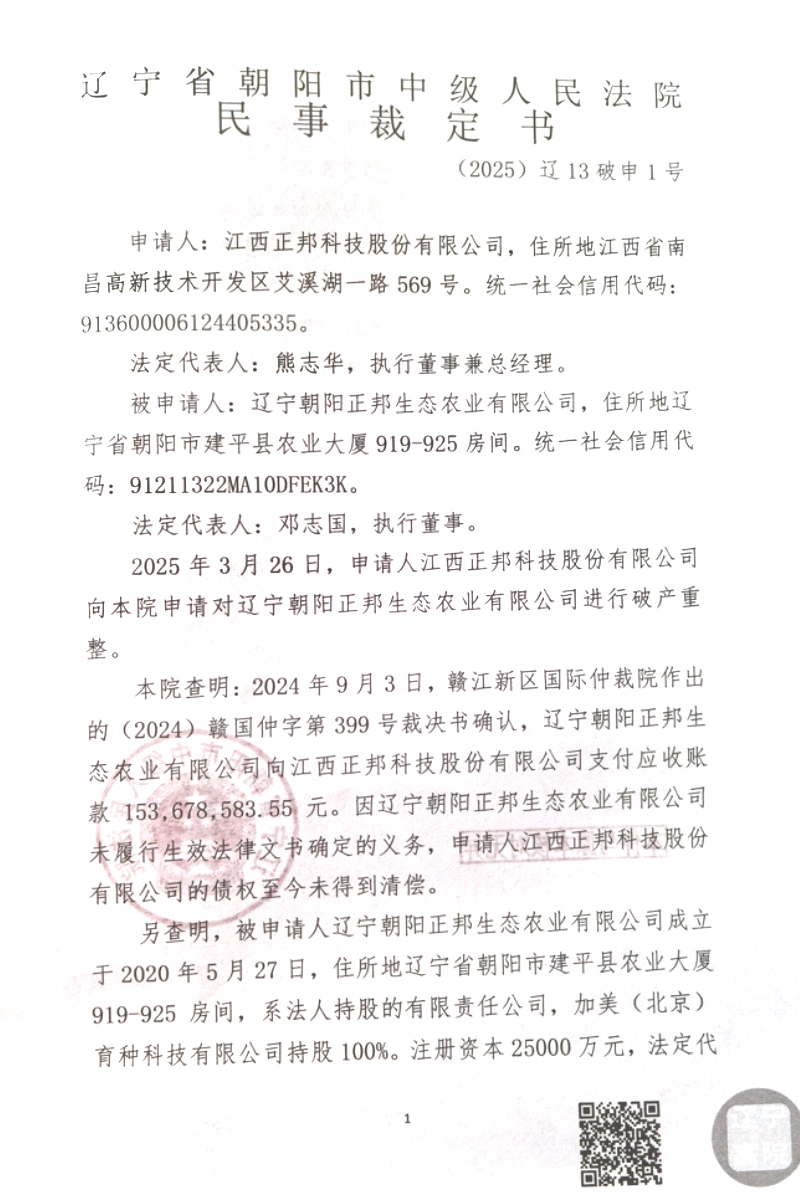

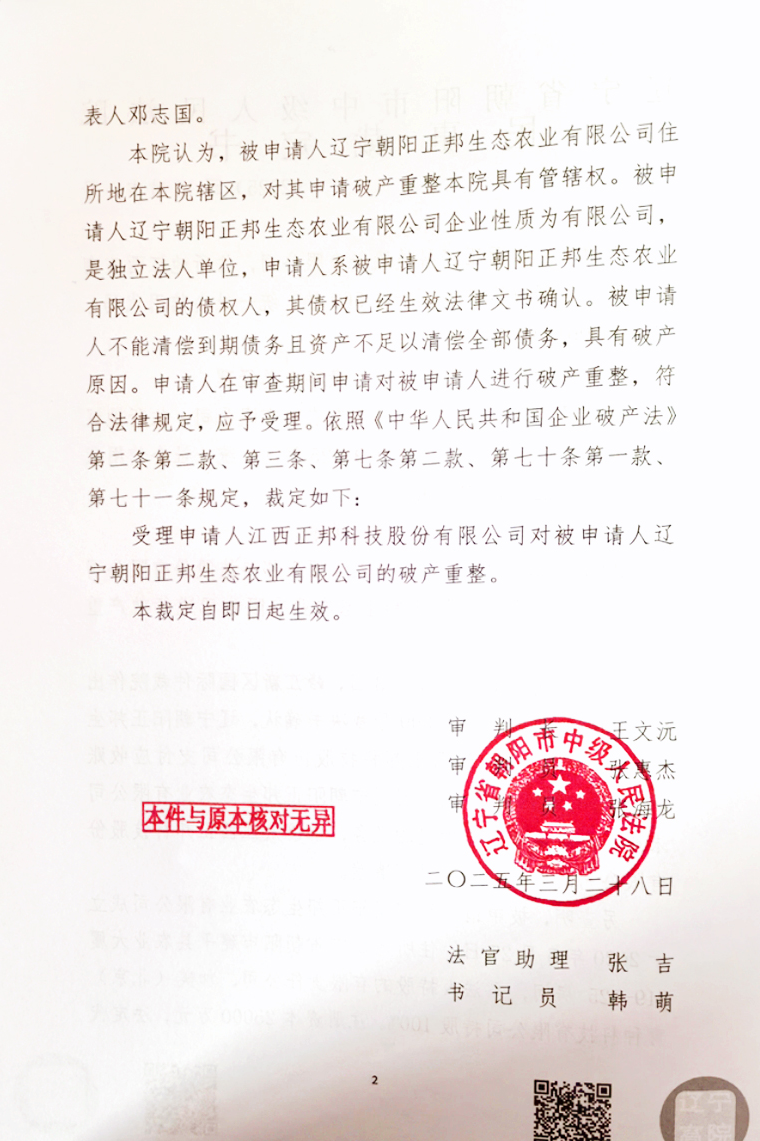

This development follows Zhengbang Technology’s own bankruptcy restructuring petition in March 2025, after Chaoyang Zhengbang failed to repay over CNY 150 million (about USD 20.89 million) in receivables. The March filing was registered as case number “(2025) Liao 13 Po Shen No.1,” while the latest decision carries the case number “(2025) Liao 13 Po Shen No.8.” Authorities in Chaoyang have since convened meetings to address the company’s financial and social risks, underscoring the severity of the crisis.

Potential support from Shuangbaotai Group

In a sign of optimism, Shuangbaotai Group—the same industrial investor that led Zhengbang Technology’s successful restructuring completed in December 2023—has applied to participate as a industrial investor in Chaoyang Zhengbang’s reorganisation. Should the process succeed, the company could optimise resource allocation and recover operations, potentially achieving annual output value exceeding CNY 3 billion (about USD 417.83 million).

Chaoyang Zhengbang’s management highlighted that the court-led restructuring aligns with government efforts to improve the business environment and support private enterprises. Xinhua News Agency reported that full capacity operations could significantly bolster the local economy.

Zhengbang’s turnaround fuels confidence

Zhengbang Technology’s own restructuring is viewed as a model for Chaoyang Zhengbang’s potential revival. Supported by Shuangbaotai Group, the company restarted 59 hog farms and 16 feed mills in 2024. That year, feed sales reached 1.24 million tonnes, a 94% increase year-on-year, while 4.15 million hogs were marketed, and breeding sow inventory recovered to 275,000 head. Production costs dropped sharply, with weaned piglets falling from nearly CNY 600 (about USD 83.57) per head at the end of 2023 to below CNY 400 (about USD 55.71) in 2024, and finishing pigs’ costs decreasing from CNY 20 (about USD 2.79) per kg to about CNY 13.30 (about USD 1.85) per kg by March 2025.

These operational improvements brought Zhengbang Technology’s asset-liability ratio down to 46.42% at the end of 2024, a reduction of 7.5 percentage points from the beginning of the year. Shuangbaotai Group, meanwhile, achieved a milestone by surpassing CNY 100 billion (about USD 13.93 billion) in revenue for the first time in 2024, with sales revenue rising 37.1% year-on-year in the first five months of 2025.

Under Zhengbang Technology’s restructuring plan, Shuangbaotai Group has pledged to gradually inject its hog farming and feed assets into the listed company within two years of the restructuring’s completion and complete the overall listing of its related businesses within four years. The outcome of Chaoyang Zhengbang’s pre-reorganisation could thus prove pivotal for the group’s broader strategic roadmap.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.