Wens has acquired Fujian Hake Ecological Agriculture Co., a pig breeding subsidiary of Aonong Bio, for approximately USD 16.4 million. The deal is part of Wens’ strategy to strengthen its genetic resources and piglet supply in southern China. The transaction also helps Aonong restructure its operations and settle outstanding debts, as it shifts focus to a leaner breeding portfolio. The move underscores ongoing consolidation trends in China’s pig industry.

Chinese livestock heavyweight Wens has unveiled a major acquisition plan aimed at consolidating its pig breeding operations and enhancing supply chain efficiency. Through its subsidiary, Guangdong Wens Pig Breeding Technology Co., the firm will purchase 100% of Fujian Hake Ecological Agriculture Co., a subsidiary under the struggling Aonong Bio group, for CNY 118.70 million (about USD 16.40 million).

Fujian Hake’s High-Rise Pig Farm

The move, announced on April 15, underscores Wens’ intention to deepen its genetic stock and secure future piglet supply, especially in southern China. Hake, once a flagship high-rise pig breeding facility developed by Aonong, housed 2,500 purebred Danish-origin sows at peak and could deliver over 75,000 piglets per year.

A Debt-Laden Asset Repackaged for Value

The transaction is not only an asset reallocation exercise but also a crucial debt resolution strategy. Aonong Bio’s wholly owned subsidiary, Fujian Aoxin Biotechnology Group, owns 55% of Hake and will receive approximately CNY 65.29 million (about USD 9.02 million) from the deal.

However, Hake has been under financial strain, with a lingering CNY 80 million (about USD 11.05 million) loan from Agricultural Bank of China’s Yongding branch dating back to 2020. As of now, CNY 31.14 million (about USD 4.30 million) remains unpaid, prompting the bank to initiate legal action for asset enforcement. This raised fears of breeding stock and other biological assets through forced auction.

To navigate the impasse, the agreement includes a mechanism whereby Wens will provide advance payment to Hake’s minority shareholders, who will in turn extend loans to the company to settle the debt and lift related collateral obligations. This arrangement serves as a precondition for completing the official ownership transfer.

Restructuring in Motion for Aonong

The transaction marks a significant pivot for Aonong, which is refocusing its swine operations around core breeding assets. Post-sale, the company will retain two national core sow breeding farms and one national core boar station, which it says are sufficient to support its revised production strategy.

The disposal is also financially strategic. By avoiding asset fire sales triggered by judicial auctions, Aonong mitigates deeper losses. Furthermore, the infusion of cash from the sale will alleviate pressure on its balance sheet, though the transaction is forecast to reduce its 2025 net profit by approximately CNY 5 million (about USD 700,000).

Aonong’s broader restructuring is evident in the fading footprint of its once extensive core breeding infrastructure. The recent national livestock breeding registry no longer lists its former flagship facility in Guangxi, and another operation in Shandong has also lost its core station designation.

Wens Strengthens Regional Breeding Infrastructure

For Wens, this acquisition is a calculated expansion of its breeding capabilities. The company noted that the deal “aims to optimize pig production resource allocation, strengthen regional layout, and elevate the overall competitiveness of its breeding supply chain.” It also reinforces Wens’ capacity to support vertically integrated pig production with reliable, high-quality genetic inputs.

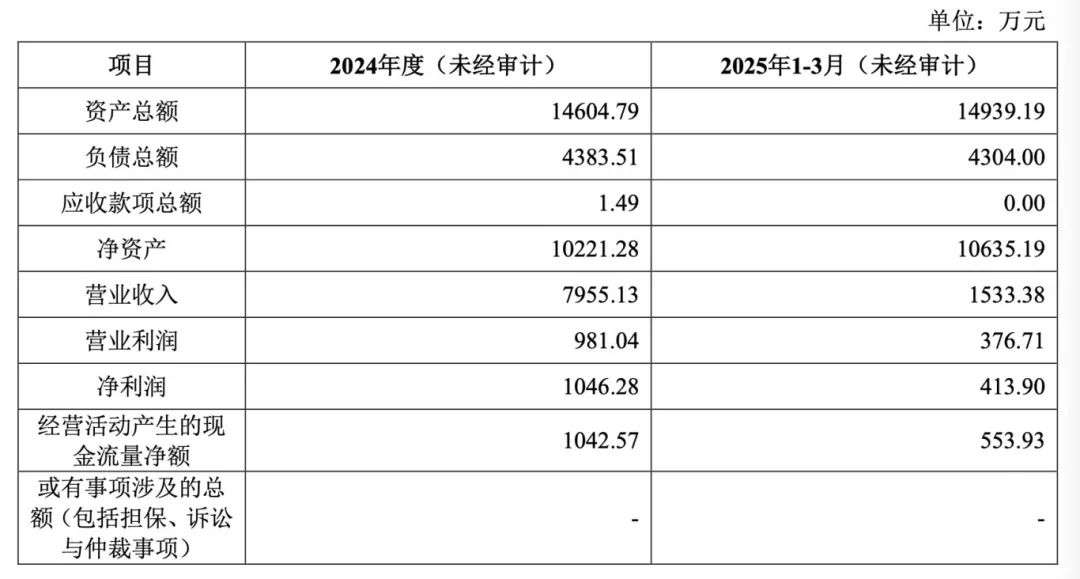

Main Financial Figures of Fujian Hake

Financially, Hake recorded revenue of CNY 79.55 million (about USD 11.00 million) and net profit of CNY 10.46 million (about USD 1.45 million) in 2024. Its asset base includes CNY 146 million (about USD 20.15 million) in total assets and CNY 102 million (about USD 14.08 million) in net assets as of year-end 2024.

This transaction underscores an ongoing evolution in China’s livestock sector, where firms seek strategic exits or consolidation amid mounting financial and regulatory pressure. For Wens, it represents a continued commitment to quality genetics and supply security; for Aonong, it is a necessary retreat to regroup and refocus.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.