In 2024, China’s broiler industry continues its transition, with white-feather broilers strengthening their market dominance while yellow-feather broiler production declines. Total broiler output reached 14.84 billion birds, with white-feather broilers contributing 72.17% of chicken meat production. Although broiler prices have dropped, declining feed costs have cushioned profitability pressures. However, China remains 72% reliant on foreign breeding stock, raising concerns over self-sufficiency. To ensure stability, industry experts advocate for expanding domestic breeding programs, improving marketing strategies, and leveraging global trade opportunities.

Structural Shifts in Broiler Production

China’s broiler industry is undergoing a significant transformation in 2024. According to the latest report from the China’s National Broiler Industry Technology System, total broiler production—including white-feather broilers, yellow-feather broilers, and small white-feather broilers—reached 14.84 billion birds, reflecting a 1.02% year-on-year increase. However, this overall growth masks contrasting trends among different broiler types:

- White-feather broilers: 9.03 billion birds, up 2.24% from 2023

- Yellow-feather broilers: 3.33 billion birds, down 7.25%

- Small white-feather broilers: 2.48 billion birds, up 9.36%

From a production volume perspective, white-feather broilers continue to dominate, contributing 17.79 million tonnes of chicken meat, 72.17% of total output. Meanwhile, yellow-feather broilers produced 4.32 million tonnes, representing 17.53%, a declining share compared to previous years.

The shift underscores the growing preference for white-feather broilers, which are favored for their efficiency in large-scale industrial production. However, the standardised production system for yellow-feathered broilers has lagged behind, with key challenges including high production costs and inconsistent performance. There is an urgent need to enhance the development of standardised facilities, equipment, and technical supports to improve overall efficiency..

Market and Cost Developments

The 2024 market landscape presents challenges for broiler farmers, particularly with declining prices:

- White-feather broiler price: CNY 7.79/kg (USD 1.08/kg), down 12.28% year-on-year

- Yellow-feather broiler price: CNY 15.95/kg (USD 2.21/kg), down 0.79%

Despite falling prices, lower feed costs have helped mitigate profitability pressures:

- Corn price: CNY 2.53/kg (USD 0.35/kg), down 14.84%

- Soybean meal price: CNY 3.62/kg (USD 0.50/kg), down 21.37%

- Total feed costs: Down 8.56% from 2023

Consequently, the average production cost per kilogram of chicken now stands at CNY 7.74/kg (USD 1.07/kg) for white-feather broilers and CNY 13.24/kg (USD 1.83/kg) for yellow-feather broilers.

Profitability trends show a mixed picture:

- White-feather broilers: CNY 0.76 per bird, down CNY 0.21

- Yellow-feather broilers: CNY 5.85 per bird, up CNY 1.50

This indicates that while yellow-feather broiler production is shrinking, it remains more profitable on a per-bird basis due to higher selling prices.

Breeding and Self-Sufficiency Challenges

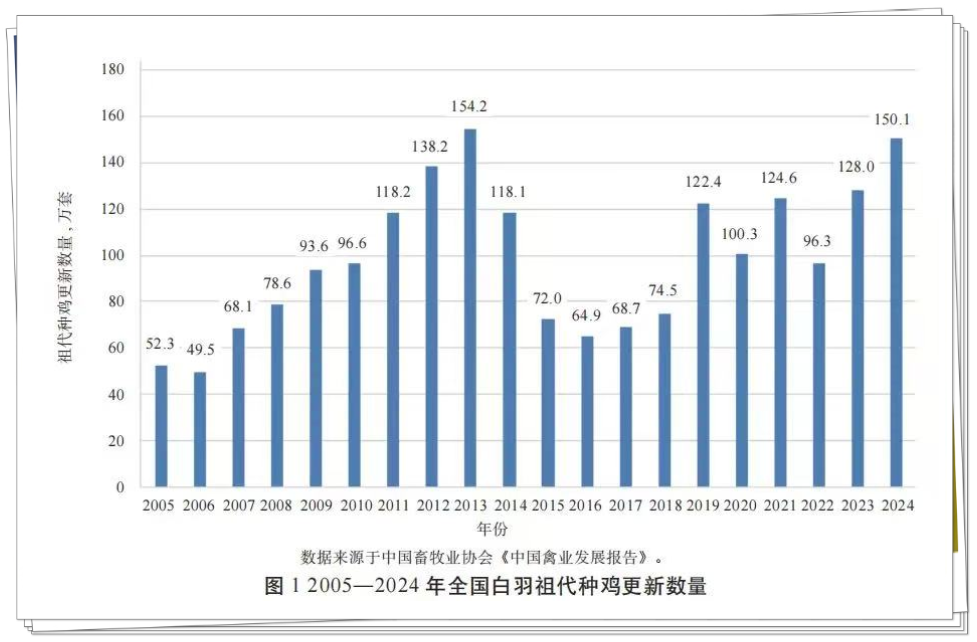

China’s continued reliance on imported genetic stock for white-feather broilers remains a strategic concern. The report highlights that grandparent stock imports reached 1.50 million sets, a 17.25% increase from 2023, nearing the record high of 1.54 million sets in 2013.

Breakdown of imported vs. domestic breeding stock:

- Imported grandparent stock: 674,600 sets (44.96%)

- Domestic grandparent stock (locally bred by companies like Cobb-Vantress and Aviagen): 826,100 sets (55.04%)

Despite progress in domestic breeding, foreign dependency remains substantial. China’s three domestic white-feather broiler breeds—Shengze 901, Guangming 2, and Wode 188—now account for 28% of the market, but the industry remains 72% reliant on foreign genetics. The report warns that China has yet to achieve a self-sufficiency level that would safeguard against potential import disruptions.

Key Challenges and Strategic Priorities

The report outlines several pressing challenges for China’s broiler industry:

Weak Domestic Demand for Chicken Meat

- Despite its affordability, chicken consumption growth remains sluggish due to slow income growth and shifting dietary habits.

- Branding and marketing efforts lag behind those of leading poultry-consuming nations, limiting demand expansion.

Heavy Reliance on Foreign Breeding Stock

- Over 70% of white-feather broiler genetics still depend on imports.

- A lack of fully independent breeding programs poses risks to industry stability.

Disease and Biosecurity Risks

- Ongoing avian influenza outbreaks worldwide increase the risk of disease transmission.

- Domestic biosecurity measures and disease control infrastructure require further investment.

Slow Progress in Standardization and Mechanization

- Smart ventilation systems are still underdeveloped, leading to inefficient environmental management.

- The yellow-feather broiler sector lags in mechanization, contributing to higher production costs and performance inconsistencies.

- Manual chicken-catching remains widespread, as existing mechanized solutions often lead to bird injuries.

Policy and Market Strategies for Sustainable Growth

To address these challenges, the report recommends a multi-faceted approach:

Boosting Domestic Breeding Capabilities

- Expand government subsidies for domestic white-feather broiler breeding programs.

- Increase breeding trials in key provinces such as Hebei, Inner Mongolia, Liaoning, Shandong, and Henan.

- Provide financial incentives to poultry breeding companies investing in local genetic development.

Strengthening Market Positioning and Branding

- Enhance consumer education on chicken’s nutritional benefits.

- Encourage brand differentiation between white-feather and yellow-feather broilers to cater to diverse market segments.

Leveraging Global Trade Opportunities

- Expand broiler exports through initiatives like the Belt and Road Initiative.

- Strengthen supply chain partnerships with major poultry-importing nations.

By prioritizing domestic breeding, targeted branding, and export expansion, China aims to enhance the long-term sustainability of its poultry industry while reducing reliance on external suppliers.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.