Axiom, France’s largest pig-breeding group, is deepening China localisation via live animals, semen, and breeding services, while pushing frozen embryo transfer for full commercial use by 2030; embryos deliver 100% genetics versus about 87.5% via semen across three generations, fit welfare and quarantine rules, and support contract-based partnerships, with semen sales to China likely to surpass live imports by 2026.

Following May 2024’s China–France joint statement on agricultural exchange, French president Emmanuel Macron’s latest visit to China again underlined deeper ties in farming. The new communiqué highlights exploring fresh cooperation models, including co-op style exchanges—opening the door to more practical, technical collaboration in agriculture and agri-food.

Within that context, France’s swine genetics exports have the wind at their back. Axiom—the country’s largest pig breeding group—has been steadily expanding in China. On the back of business integration and a refreshed brand, the company now works on three tracks at once: live breeding stock, boar semen supply, and on-farm breeding services, all aimed at more localised operations in China.

Guillaume Lenoir

Embryos set the tone

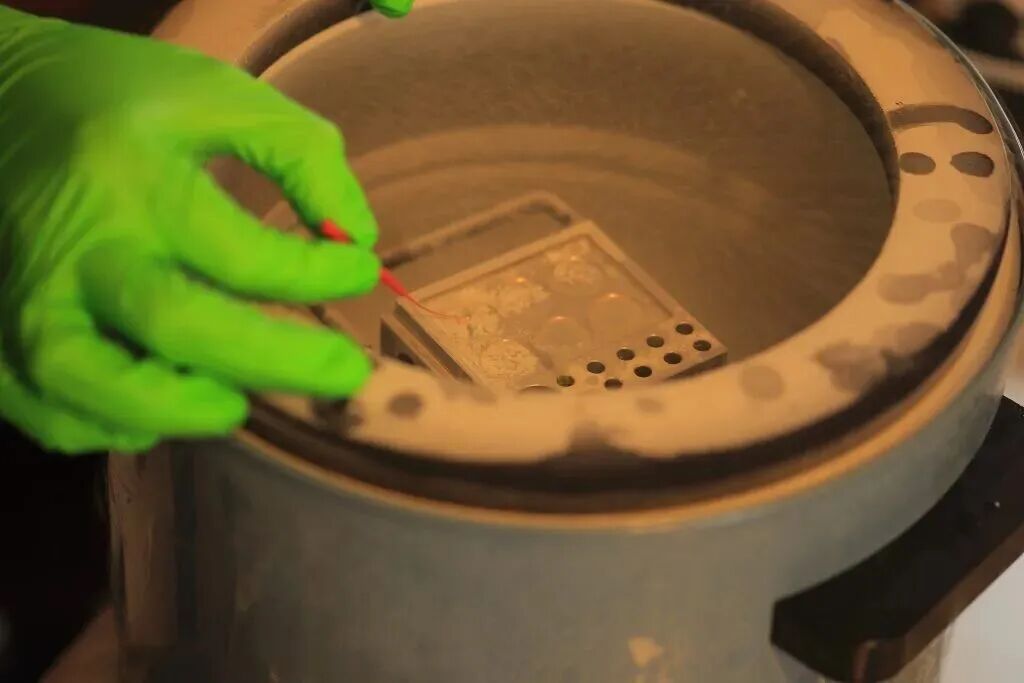

At the 6th Global Pig Genetic Progress Summit (GPGS) in Nanjing, Axiom showcased a front-edge route for gene dissemination: frozen embryo transfer. The company is the first swine breeder to have completed an intercontinental transfer of fresh pig embryos—from France to Canada—and has set a target to bring the technology into full commercial use by 2030.

“Embryo transfer reduces dependence on live-animal trade, fits a tougher geopolitical environment, and meets the industry’s higher bar for genetic delivery,” said Dr Guillaume Lenoir, global breeding director, Axiom. “An embryo carries 100% of the intended genetics. By comparison, using boar semen for stepwise genetic improvement yields about 87.5% after three generations.”

Embryos also help on two practical fronts: they align better with animal-welfare and import-quarantine requirements, and they establish pregnancy under local farm conditions, improving adaptation and health of the offspring.

“Axiom spreads superior genetics without keeping anything back—from live animals, to semen, to embryos,” said Dr Huang Zhiquan, general manager, Axiom China. “Even without a deeper breeding partnership, in theory our customers won’t need to keep importing breeding stock. Our breeding service exists to prevent genetic regression after import. Sustained local production and less reliance on live imports is a strategic direction for us, and making high-value genetics simple and convenient to move is what a specialist breeder should do.”

A shareholder-backed breeder, not a co-op

Unlike many European agricultural companies owned directly by farmer co-ops, Axiom is a specialist breeder formed by major agri groups. Shareholders include Agrial and Terrena in France. That structure, said Huang, keeps the company R&D-driven and client-oriented, while enabling growth through integration and M&A.

Axiom’s roots go back to Gene+ (founded 1989). In 2016, Gene+ merged with French breeder ADN to form Axiom; in 2023 Axiom acquired Choice Genetics (CG). The expanded Axiom group now ranks among the global top five pig breeding companies by scale.

Huang Zhiquan

From two initial nucleus farms to 20-plus today, growth has coincided with continuous innovation. Gene+, for instance, developed the first Sino-European line in 1995—a great-granddam (GG) carrying 50% Meishan genetics. The France-to-Canada embryo work scored its first success back in 2013. During GPGS, Axiom also presented, via Dr Wang Xiangguo, associate professor, Beijing University of Agriculture, progress on sex-control plus ambient-temperature semen technologies—and the prospects to move these from research into practice in the coming years.

Two founding shareholders still hold seats, helping Axiom stay focused on breeding while also tapping full-chain pork production feedback through shareholder operations. “This is different from a breeder doing the full chain itself, or being just one piece of a co-op,” Huang explained. “Our shareholders are not obliged to use Axiom genetics. That means we must serve their production needs, and at the same time win in the open market.”

Full market exposure has pushed Axiom to customise breeding indexes for different customers—growth rate, meat quality, or disease resistance—by weighting traits to order. Regardless of direction or region, Axiom opens its data software to clients, shares breeding know-how, and captures broad feedback loops. “A lot of data doesn’t just come from our shareholders. That is breeding across the whole value chain in the true sense,” said Huang.

Contracts over equity—and flexible AI partnerships

“Deep cooperation” in China often implies equity ties. In France, Axiom prefers contractual clarity to define rights and duties—also the basis for continuous data sharing downstream. That approach runs through Axiom’s projects, including planned core nucleus facilities outside France. Even where those sites are designated as Axiom selection units, collaboration across selection, production management, and market access is framed by agreements—sharing both risk and return.

For existing genetics partners, weekly data swaps are standard, and artificial insemination (AI) projects take cooperation deeper. “It doesn’t have to mean building a boar station,” said Huang. “We can do custom semen, custom boars, or managed operations. There’s no single template—as long as roles, responsibilities, and benefits are clear, and both sides win. If customers want it, we’re open to mutual equity participation too.”

With China’s quarantine-site constraints slowing live imports industry-wide, Axiom has leaned on mature cross-border fresh/frozen semen supply. Combined with its halothane-gene–free, high-resilience Pietrain line, semen sales to China have surged and, by Axiom’s projections, could overtake live-animal sales by 2026.

A wider footprint—and support that follows China

Post-CG acquisition, Axiom’s subsidiary footprint now includes Brazil, Spain, and Poland. The China support team has been strengthened, and for strategic partners the group concentrates global resources. Some France-based technical staff have opted to base themselves in Southeast Asia for visa, travel, and living convenience—yet their main remit is to support Axiom China, while also serving local partners.

That Southeast Asia experience has created another edge: helping global clients—especially Chinese partners—“go overseas” into Southeast Asia, with teams that understand both markets.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.