Muyuan hit 100% slaughter-capacity utilisation in Q3 2025 and posted its first quarterly profit (>CNY 30m). Jan–Sep: 19.16m head (+140% YoY), 88% average utilisation; Q3 margin 1.5%→2.5%, cut products >30%. Plans: full-year turnaround, add 1-2 plants per year. Shuanghui: 9.13m head (~48% utilisation), no new plants, piloting asset-light in Puyang.

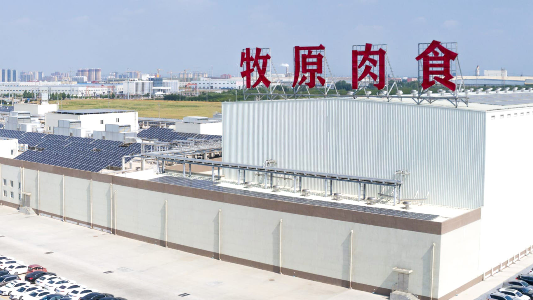

After overtaking Shuanghui in 2023 to become China’s largest hog slaughterer, Muyuan has now pushed slaughter capacity utilisation to 100% in the third quarter, chalking up its first quarterly profit in the segment.

From January to September 2025, the company slaughtered 19.16 million hogs, up 140% year-on-year, with an average capacity utilisation of 88%. In Q3 alone, utilisation reached 100%, delivering a single-quarter profit of over CNY 30.00 million (over USD 4.18 million).

“Profitability in our slaughter business mainly stems from sustained gains in capacity utilisation, broader sales channels, stronger customer service, and a better product mix,” said board secretary Qin Jun, Muyuan. He added that the company will ride the consumption peak ahead of Spring Festival to broaden its customer base and sales outlets, lift product quality and service, and strive to swing full-year results to profit.

Cut products drive the mix shift

Compared with Q2, Muyuan’s Q3 slaughter volume rose 27%, while gross margin improved from 1.5% to 2.5%. Throughout the quarter, the company prioritised cut products: average daily deboning/portioning has reached about 30,000 head, and the cutting ratio now exceeds 30%, roughly 5 percentage points higher than in Q2.

“With total slaughter more than doubling, and the share of cut products also ticking up by several points, we have a solid reason to stay optimistic about next year’s earnings,” said Qin.

Capacity plans: steady, asset-light aware

As of now, the 2 largest domestic players have installed slaughter capacity of roughly 29 million head (Muyuan) and 25 million head (Shuanghui). Their slaughter volumes were 13.26 million and 12.52 million in 2023 and 2024 for Muyuan, versus about 12.75 million and 10.28 million for Shuanghui, respectively. In the first three quarters of this year, Shuanghui’s slaughter rose 26% to 9.13 million, implying a capacity utilisation of about 48%.

Looking ahead, Qin said this year’s slaughter volume at Muyuan “will more than double last year’s,” with 2026 expected to grow further. “Over the long term, we will gradually commission planned but yet-to-be-built slaughter capacity—perhaps 1–2 new plants per year—and steadily raise the share of slaughter within our total marketings.”

Shuanghui, for its part, recently told investors it has no plans for new greenfield plants, but trialled an asset-light slaughter model in Puyang, Henan, with a local partner and will actively consider that route for future capacity expansion.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.