Tecon plans to acquire 51% of Xinjiang Qiangdu Animal Husbandry, emphasizing capacity integration rather than expansion to align with China’s hog-supply regulation. Qiangdu runs a self-breeding, self-raising chain in southern Xinjiang and has remained profitable since 2020. The deal would lift Tecon’s breeding sow inventory from about150,000 to about230,000 and deepen its regional integration. In H1, Tecon reported CNY 8.85 billion revenue (+10.68%) and CNY 338 million net profit (+22.27%); hogs led volumes, while protein-oil processing and corn storage surged.

At its half-year results briefing on September 1, Tecon clarified plans to buy a controlling stake in Qiangdu Animal Husbandry, saying the deal is an integration on the company’s existing hog capacity, with no new capacity added—a stance it says aligns with China’s current hog supply regulation policies. “We are also consulting relevant departments to ensure smooth follow-up,” the company noted.

On August 26, Tecon signed a framework agreement with Xinjiang Qixing Qiangdu Group Agriculture & Animal Husbandry Co., Ltd., proposing a cash acquisition of 51% of Xinjiang Qiangdu Animal Husbandry Technology Co., Ltd. . The transaction remains subject to due diligence, audit, and valuation, followed by further analysis, negotiation, and the necessary approvals.

Why Qiangdu?

According to Tecon, Qiangdu runs a self-breeding and self-raising model, with a relatively complete chain from breeding stock, commercial hogs, and through to slaughter and processing. As one of the key hog producers in southern Xinjiang, its scale and footprint carry weight in the local livestock sector.

For Tecon, the partnership is designed to accelerate the growth of its hog business, lift market share, and strengthen overall competitiveness—while deepening integration within Xinjiang and supporting regional market expansion.

Accourding to Industry data fromNewPigs, Tecon currently manages around 150,000 breeding sows; after the acquisition, the figure would rise to 230,000.

A familiar partner with a cost edge

The company added that Qiangdu is based in Ruoqiang County, has been in livestock for over a decade, and has delivered strong operating and production performance. It has reported profits consistently since 2020, including during the tough pricing years of 2021 and 2023.

The two sides go back some way: Tecon previously supplied feed to Qiangdu; in 2023 they set up a joint-venture feed company; and in the first half of this year, after multiple rounds of talks, they reached a preliminary intention to cooperate in hog production.

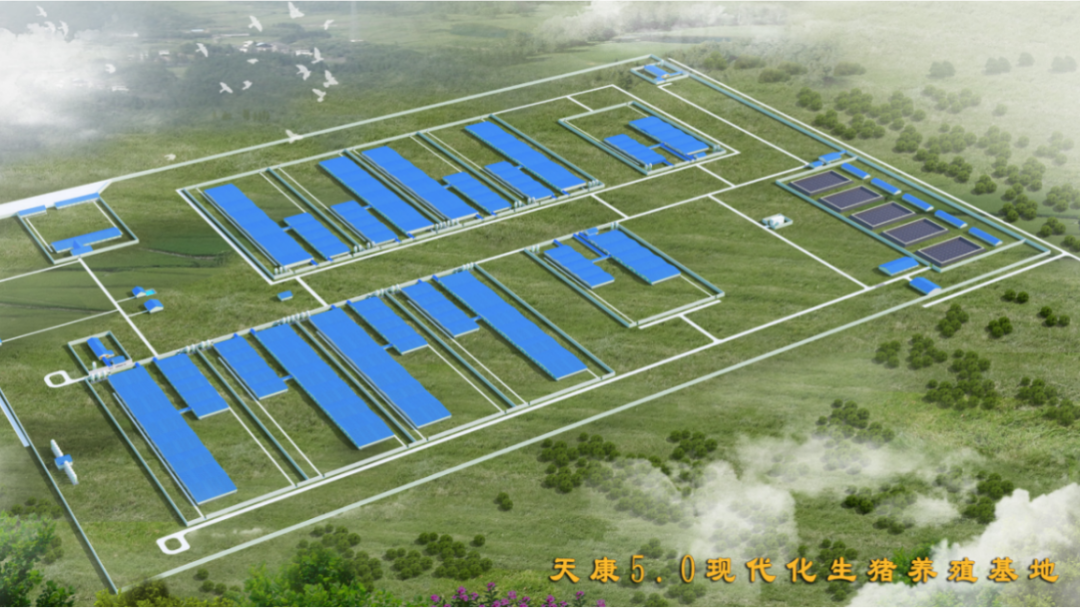

On costs, Tecon pointed to Qiangdu’s location at the edge of the Taklamakan Desert—dry, remote, and away from residential zones—which reduces disease pressure. With production, feed, and slaughter bases situated close together, logistics are leaner; production and technical management are described as standardised and well-run.

Commenting on the broader picture, President of the China Association for Public Companies Song Zhiping argued that mergers and restructurings help companies move from fragmentation to cohesion—an effective path out of industry “involution.” Combining forces can improve listed-company quality, raise concentration, and create conditions to reduce output and capacity for a healthier market.

Half-year snapshot: hogs lead, diversification rises

In the first half, Tecon reported revenue of CNY 8.85 billion (USD 1.23 billion), up 10.68%, and net profit attributable to shareholders of CNY 338 million (USD 47.06 million), up 22.27% .

Hog production remained the largest contributor. The company marketed 1.528 million hogs, up 9.05%, with hog sales revenue of CNY 2.85 billion (USD 396.52 million), down 0.95% year-on-year.

Among other businesses:

- Feed: sales volume 1.341 million tonnes (-0.58%); sales revenue CNY 2.43 billion (USD 339.14 million), down 14.24%.

- Animal vaccines: revenue CNY 482 million (USD 67.13 million), down 3.67%.

- Vegetable protein oils processing: revenue CNY 1.449 billion (USD 201.53 million), up 97.60%.

- Corn storage: revenue CNY 1.305 billion (USD 181.73 million), up 72.32%.

Tecon said the protein-oil plant it built with 海大 (Haid) came on-line in Q4 last year, focused on 60 dephenolised cottonseed protein; most output goes to Haid, with healthy profitability reported.

Operations & efficiency

The hog unit mainly follows a self-breeding and self-raising pathway from genetics and multiplication to finishing and slaughter, and plans to continue with this model while supplementing with contract farming (company + farmer model) as scale grows.

Key production metrics in H1: PSY 27, fattening survival 96.5%, and an in-house self-breeding and self-raising cost of CNY 12.55 per kg (USD 1.75 per kg). The overall cost-down trend slowed due to pricier purchased piglets within certain feed-segment grow-out services, but management expects more room to reduce costs as purchased piglet prices fall.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.