Lihua, China’s second-largest yellow-feather broiler company, is rapidly advancing toward a dual-business model across poultry and swine. Driven by robust growth in pig production and strategic investments in breeding and slaughtering capacities, Lihua mirrors the trajectory of Wens. With record sales and improved profitability, the company is emerging as a key player reshaping China’s livestock sector.

Lihua, traditionally recognized as China’s second-largest producer of yellow-feather broilers, is now decisively expanding into the swine sector. Following the blueprint of Wens Group, the industry leader, Lihua is actively pursuing a “dual-engine” model, leveraging both poultry and swine operations to drive future growth.

According to Lihua’s 2024 annual report, the company’s poultry business generated CNY 14.53 billion (about USD 2.01 billion), marking an 8.01% year-on-year increase and accounting for 81.98% of its total revenue. Meanwhile, its swine business witnessed a substantial surge, with sales revenue climbing 76.51% to CNY 2.93 billion (about USD 405.00 million), representing 16.51% of its total revenue. This compares with a 2023 distribution of 87.63% poultry and 10.80% swine.

In 2024, Lihua sold 516 million yellow-feather broilers, a 12.95% increase year-on-year. More notably, its swine sales broke the one-million-head milestone, reaching 1.298 million heads—an impressive 51.8% increase. Full-year net profit attributable to shareholders rose sharply to CNY 1.52 billion (about USD 210.30 million), returning the company to profitability.

At its first-quarter 2025 earnings call, Lihua disclosed continued momentum. Poultry sales rose 8.69% to 123 million birds, while swine sales skyrocketed 150.49% to 483,700 heads. Quarterly net profit surged 157.47% to CNY 206 million (about USD 28.50 million).

“From a business perspective, the surge in hog sales volume, coupled with a decrease in complete production costs to CNY 13 per kilogram (about USD 1.8 per kilogram), meant that pig farming contributed the majority of operating profits in the first quarter. The company’s dual-engine strategy is now effectively materializing,” Lihua noted.

Scaling Up Swine Ambitions

Looking ahead, Lihua plans to maintain an annual 8%-10% growth rate in broiler sales, while ambitiously expanding its swine sector. Currently, the company maintains a breeding stock of nearly 100,000 sows. Its 2025 goal: 2 million pigs sold, with a target production cost of CNY 12.8 per kilogram (about USD 1.78 per kilogram).

“Anchored in the Yangtze River Delta, Lihua’s next goal is to evolve into a leading enterprise with an annual output of 3 million pigs,” the company stated.

To support its swine expansion, Lihua is advancing upstream in the supply chain, strengthening its genetic resources. It operates two major core breeding farms in Lianyungang and Jiangyan, focusing on enhancing the performance and health profiles of Duroc, Landrace, and Large White breeds. Notably, the Yuntai breeding facility has passed the national core breeding farm certification, underscoring its commitment to genetics excellence.

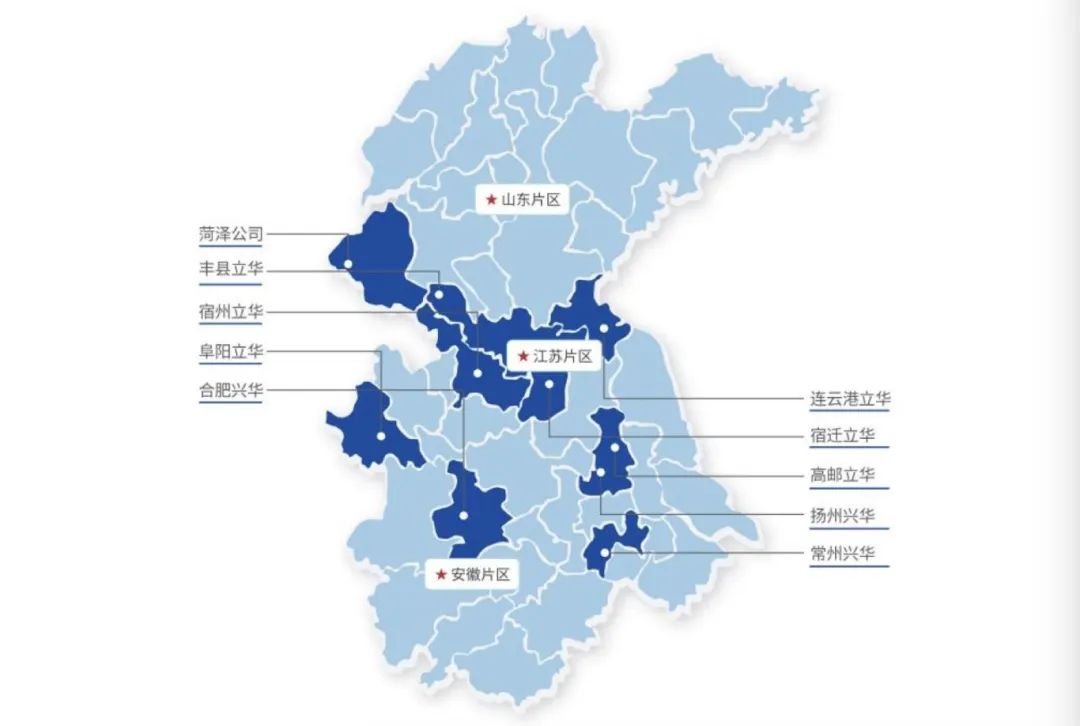

Lihua first entered pig farming in 2011, concentrating operations in Jiangsu, Anhui, and Shandong provinces. Its hog sales primarily target the East China, offering competitive pricing advantages. In 2024, the average selling price of Lihua’s commercial pigs reached CNY 17.30 per kilogram (about USD 2.39 per kilogram), up 14.57% year-on-year.

Efficiency Driving Profitability

Due to improved production efficiency, declining feed material costs, and expanding sales volume, Lihua successfully reduced its overall pig farming costs. The average full-year cost fell to CNY 14.92 per kilogram (about USD 2.06 per kilogram), dipping below CNY 14 per kilogram by year-end.

Coupled with the cyclical recovery of China’s pig farming sector, these cost improvements enabled Lihua to achieve solid profitability in its swine division. In 2024, the gross margin of its swine business reached 23.46%, significantly higher than the 14.56% gross margin of its poultry operations.

Wens, which also started with the yellow-feather broiler business, has maintained its leading position in poultry while achieving rapid growth in its swine operations. Once becoming the industry’s top player, it is now firmly holding the second position. In 2024, revenue from its poultry and swine businesses accounted for approximately 32% and 59% of the company’s total, respectively.

Following Wens example, Lihua is also advancing in poultry processing. It has built a slaughtering capacity for 120 million birds annually, with 2024 slaughter volumes hitting 60 million birds. The company projects that figure to reach 100 million in 2025, laying the groundwork for further vertical integration and tapping into China’s growing premium chilled poultry market.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.