China’s frozen duck exports have surged in 2024, with a 137% increase in frozen duck meat shipments and a 101% rise in whole frozen duck exports. Shandong Province leads in production, while global demand continues to fuel market expansion in Asia, Europe, and the Americas. Despite price fluctuations, processed duck products are expected to drive growth in 2025.

China’s duck industry is witnessing significant international growth, with frozen duck exports experiencing record-breaking expansion in 2024. According to the 2024 Waterfowl Industry and Technology Development Report by the National Waterfowl Industry Technology System, commercial meat duck production across 23 provinces and regions reached 4.22 billion birds. This yielded approximately 10 million metric tons of duck meat, generating a total production value of CNY 128.4 billion (USD 17.72 billion), marking a modest increase from the previous year.

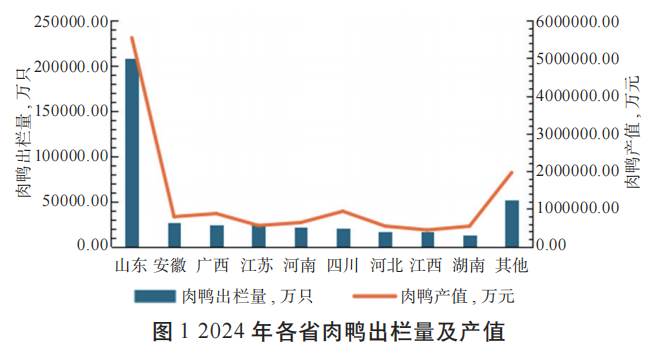

Regional Production Trends and Breed Distribution

Shandong Province continues to dominate China’s duck production, with an output exceeding 2 billion ducks and a market value nearing CNY 60 billion (USD 8.28 billion). This positions Shandong well ahead of Anhui, the second-largest producer, by 7.9 and 5.9 times in output and value, respectively.

The vast majority of duck production in China is focused on white-feathered meat ducks, which account for 83.3% of total output. Other key breeds include Muscovy ducks and hybrid Muscovy ducks (5.1%), as well as local breeds like the Mayu duck (11.6%).

- Shandong Province – Predominantly white-feathered duck production.

- Fujian & Guangdong – Leading regions for Muscovy and hybrid Muscovy ducks.

- Hunan, Jiangxi, Sichuan & Guangxi – Strongholds for Mayu duck farming.

Market Trends: Prices and Profitability

Despite growing demand, duck prices have faced fluctuations. In 2024, the average price for live ducks stood at CNY 8.77/kg (USD 1.21/kg), reflecting a decline from CNY 9.44/kg (USD 1.30/kg) in 2023. In contrast, white-feathered duckling prices surged by 14.96%, reaching CNY 3.92/bird (USD 0.55/bird), up from CNY 3.41/bird (USD 0.47/bird) in 2023. This price hike in ducklings has contributed to higher profitability for breeding farms.

Booming International Demand for Frozen Duck

Data from China’s General Administration of Customs underscores the remarkable surge in frozen duck exports:

- Whole frozen ducks – 28,100 metric tons exported (+101% YoY), valued at CNY 236 million (USD 32.60 million) (+41% YoY).

- Frozen duck parts & by-products – 22,900 metric tons exported (+137% YoY), valued at CNY 224 million (USD 30.94 million) (+99% YoY).

Conversely, exports of fresh or chilled whole ducks have declined, reflecting shifting consumer preferences and increased reliance on cold storage technologies:

- Export volume – 14,300 metric tons (-3.68% YoY).

- Export value – CNY 233 million (USD 32.19 million) (-16.4% YoY).

For the first time, China imported duck meat products in 2024, albeit in small quantities—approximately 290 metric tons of frozen duck cuts and by-products. This suggests evolving domestic demand, potentially driven by changes in consumption patterns or gaps in local production.

China’s Expanding Role in Global Duck Trade

The global waterfowl trade has traditionally centered on Asian markets but is now expanding into Europe, the Americas, and Africa. With China’s increasing export capacity and improvements in product competitiveness, the country is cementing its position as a key player in the international duck meat trade.

Looking ahead to 2025, global poultry trade is expected to continue expanding despite concerns over avian influenza and other disease challenges. Global duck meat consumption is growing at an annual rate of 2.7%, while China’s domestic market is projected to expand by 4%. Notably, processed duck products are emerging as a significant growth driver.

In 2024, China’s per capita duck meat consumption reached 6.2 kg, reflecting a 10.6% year-on-year increase. As demand continues to rise domestically and internationally, China’s duck industry is poised for further growth and strategic market expansion.

AgriPost.CN – Your Second Brain in China’s Agri-food Industry, Empowering Global Collaborations in the Animal Protein Sector.